Decoding Compliance: Choosing & Implementing the Right AML Software

In the high-stake battle against money laundering and financial crime, traditional Anti-Money Laundering (AML) methods are finding themselves outpaced by the relentless innovation by criminals. However, hope is not lost! Enters Artificial Intelligence, the champion of the modern era, a technological marvel that is revolutionising the way we combat illicit financial activities.

As we dive into the ever-evolving landscape of AML solutions, it becomes apparent that staying ahead of the game requires more than just diligence; it demands adaptability, sophistication, and a level of precision only AI can deliver.

What Does AML Compliance Entail?

AML compliance serves as the cornerstone of protecting the integrity of the financial world by preventing the infiltration of illegal funds into the legitimate economy. This is especially vital for organisations facing regulatory oversight, such as banks, financial firms, and money service businesses. Building strong AML programmes, which include clear policies and procedures, thorough training, and advanced technology, is essential for meeting compliance requirements and instilling trustworthiness in day-to-day operations.

What is the Significance of AML Compliance?

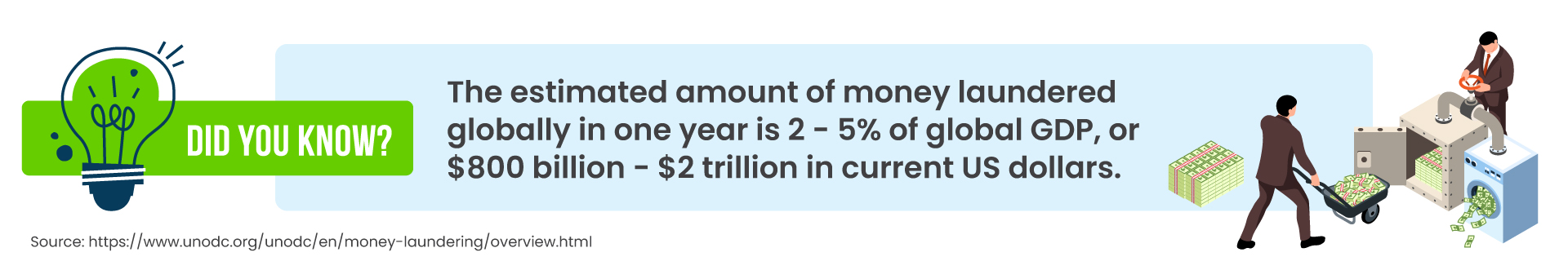

To understand how to improve your AML operations, you need to first recognise why AML compliance matters so much. AML rules are in place to make it tough for criminals to enjoy their illegal money without consequences. Since most crimes involve making money from unlawful activities, stopping these ill-gotten gains is a powerful way to reduce corruption, tax evasion, theft, fraud, and many other crimes. If we don’t control these illegal profits, they could be used for more positive purposes, like improving society and people’s lives.

In simpler terms, AML compliance isn’t just an extra thing to do or a hassle. It’s a fundamental requirement that’s essential for a fair and well-functioning society. It’s crucial that everyone in charge of your finances and business strategies understands and respects the real value of AML compliance in maintaining a clean and trustworthy financial system.

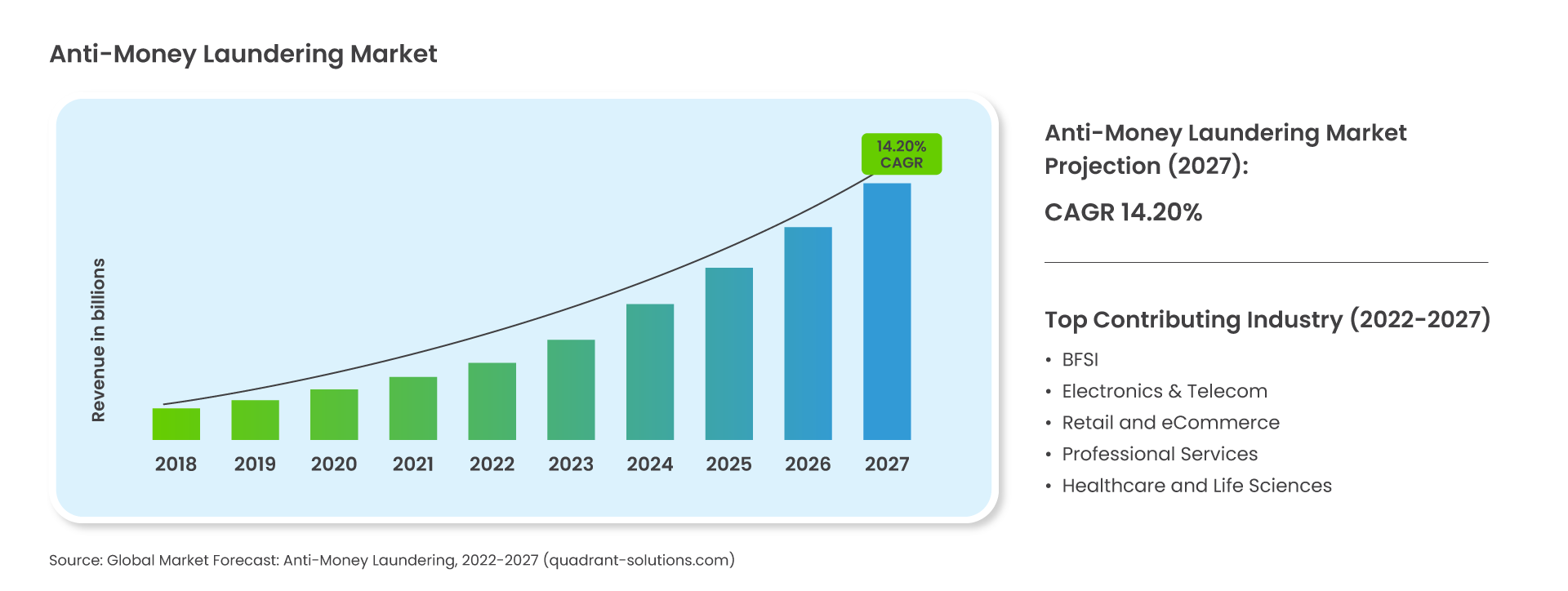

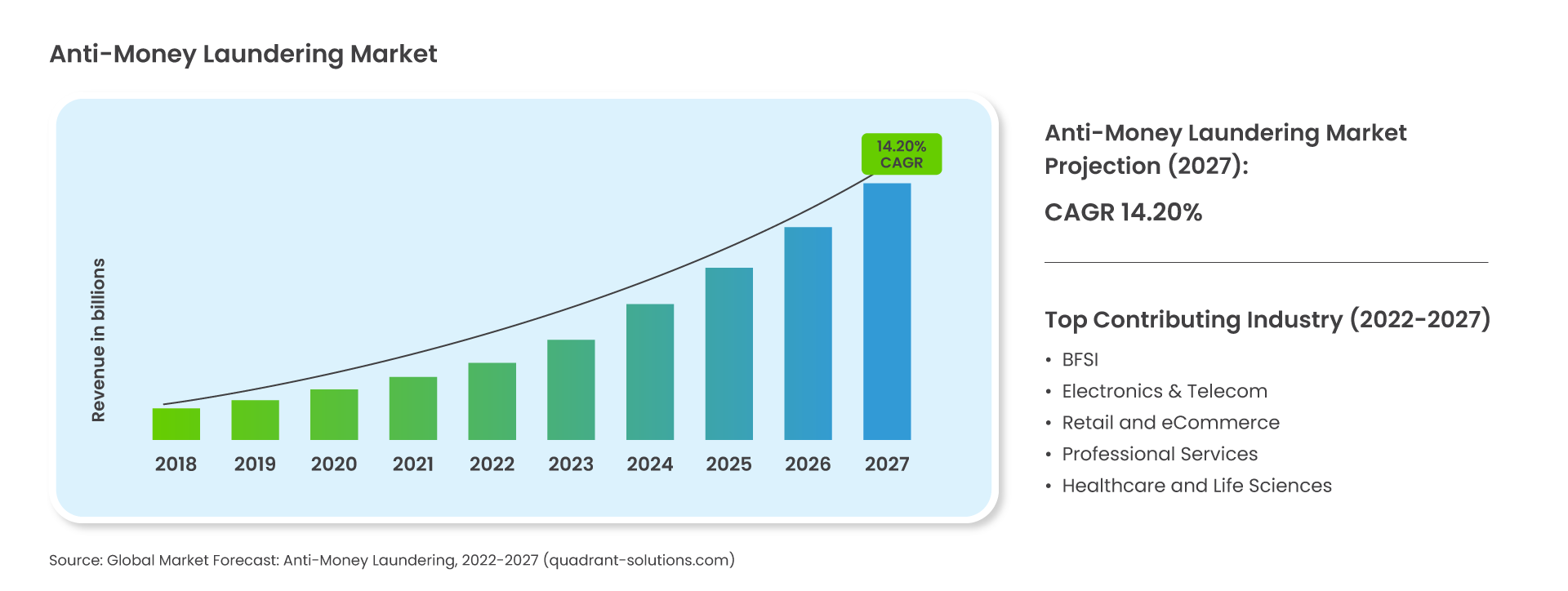

The BFSI sector’s dominance in the market, coupled with the increasing use of digital banking services and the complexity of its transactions, has made AML solutions a vital component for managing risks and ensuring compliance in this sector. These solutions are essential in the ongoing effort to combat financial crimes and protect the integrity of the financial system.

The Need for Effective AML Solution

At the heart of the problem is the challenge in rapidly accessing large volumes of data. Today, many financial institutions are using data systems that weren’t designed to handle the vast amount of data and analysis needed for AML. Fortunately, there are now various market solutions available to support smart analytics in AML. These solutions include software from major companies, data analytics tools (some with specific AML features), and even large cloud service providers. These solutions save a lot of time and money by connecting different pieces of information, making conclusions, and automatically updating machine learning models.

The importance of Anti-Money Laundering (AML) Solutions cannot be overstated in today’s global financial landscape. These solutions play a pivotal role in safeguarding the integrity of financial systems. and are instrumental for several reasons.

9 Reasons to Integrate a Robust AML Solution:

Crime Deterrence: AML solutions act as a potent deterrent against financial crimes such as money laundering, terrorism financing, and fraud. Its presence makes it more difficult for criminals to exploit the financial system to legitimise their ill-gotten gains.

Regulatory Compliance: Regulatory bodies across the world mandate AML compliance for financial institutions. Adhering to these regulations not only ensures legal compliance but also helps institutions avoid hefty fines and reputational damage resulting from non-compliance.

Risk Mitigation: AML solutions aid in identifying and mitigating risks associated with engaging with potentially illicit customers or entities. By scrutinising transactions and customer profiles, they help financial institutions make informed decisions and minimise their exposure to risk.

Preserving Reputation: A reputation for financial integrity is invaluable in the banking and financial sector. AML solutions protect the reputation of financial institutions by preventing them from inadvertently being associated with criminal activities.

Financial Stability: The prevention of money laundering and other financial crimes contributes to the overall stability of the financial system. When funds are legitimate, the system functions more smoothly, benefiting businesses, individuals, and the economy as a whole.

Global Cooperation: Money laundering knows no borders. AML solutions encourage international cooperation and information sharing among financial institutions and regulatory bodies, helping to combat cross-border criminal activities effectively.

Customer Trust: AML solutions, when implemented effectively, demonstrate an institution’s commitment to protecting its customers and the financial system as a whole. This, in turn, fosters trust among clients and stakeholders.

Operational Efficiency: Modern AML solutions often incorporate advanced technologies like artificial intelligence and machine learning, enhancing operational efficiency. They automate the process of monitoring and detecting suspicious activities, saving time and resources.

Reduction in Investigative Costs: By automating the initial stages of risk assessment and anomaly detection, AML solutions reduce the workload of human investigators. This leads to a more efficient allocation of resources for in-depth investigations where they are most needed.

In a nutshell, AML solutions are indispensable tools in the fight against financial crimes and the protection of the global financial system. Their importance extends far beyond mere regulatory compliance, encompassing crime prevention, risk management, and the preservation of trust and financial stability.

Enhancing Global Banking Security: KiyaAI’s AML Solution in Action

In today’s global financial landscape, staying one step ahead of money launderers and financial criminals is paramount. To safeguard your institution’s integrity and regulatory compliance, a powerful Anti-Money Laundering (AML) solution is crucial. KiyaAI’s AML Solution comes equipped with a comprehensive set of features designed to tackle the evolving challenges of financial crime effectively.

Explore the key features that make our AML solution a standout choice for financial institutions.

1. Comprehensive Risk-Based Approach: KiyaAI’s AML Solution employs robust data analytics to monitor and evaluate both online and offline transactions. It integrates risk scoring to specific customers, accounts, and transactions, ensuring that potential threats are identified and assessed with precision. By adopting a risk-based approach, global financial institutions get to focus its resources where they matter most, optimising their AML efforts.

2. Customisable Solution: Adapting to changing regulatory landscapes is essential for AML compliance. With KiyaAI’s solution, banks can effortlessly select, update, and monitor company policies to keep a vigilant eye on suspicious and unusual behaviour. This ensures that the institution remains agile in promptly responding to forthcoming risks and regulations, all while maintaining a robust compliance framework.

3. Interactive Dashboard: KiyaAI’s AML Solution offers an intuitive and interactive dashboard equipped with in-built data visualisation technology. This feature empowers the global organisations to gain a complete understanding of each case and make informed decisions. Visual representations of data enable quick and effective responses, helping the company stay in control of its institution’s AML efforts.

4. Fully Integrated Reporting: KiyaAI’s solution offers a fully integrated audit trails and reporting tool that simplify the often-complex task of regulatory reporting and allows businesses to confidently adhere to regulations and streamline their compliance processes.

5. Advanced Customer Profiling for Due Diligence: KiyaAI AML Solution goes beyond transaction monitoring by collecting comprehensive customer details, including KYC information, account history, transaction data, and relationship details. This 360-degree customer profile aids in comprehensive due diligence, ensuring that one has all the necessary information to identify potential risks.

6. Automated Customer Re-verification: Efficiently manage customer re-verification with the automated system, which utilises both static and dynamic parameters. This approach helps detect anomalies and eliminate threats by periodically assessing customer profiles, reducing the risk of illicit activity going undetected.

7. Real-time Transaction Surveillance: Round-the-clock transaction monitoring is crucial in today’s fast-paced financial world. KiyaAI’s AML Solution employs robust AI and ML technologies to analyse local and cross-border transactions in real-time, enabling the swift identification of suspicious activities.

8. Alert Investigation and Case Management: Integrated with end-to-end alert and case management, the intelligent AML solution provides violation details for seamless investigation and ease of access decision making. Built-in with workload balancing, alert prioritisation and customised maker-checker workflow, KiyaAI AML simplifies and accelerates case allocation and investigation.

9. Global Regulatory Compliance: KiyaAI’s AML Solutions guarantee compliance with global AML regulations, offering regular updates and adaptability for new requirements. It helps organisations stay ahead of evolving laws effortlessly, ensuring seamless operations across borders and minimising compliance risks.

Kiya.ia’s AML Solution offers a comprehensive suite of features designed to empower global institutions in the fight against financial crime. By adopting a risk-based approach, customisable rules, interactive dashboards, and comprehensive customer profiling, the organisations get to strengthen its AML strategy and stay compliant with evolving regulations. With real-time transaction surveillance and integrated watchlist screening, the firm can be confident in its ability to detect and prevent illicit financial activities.

In the high-stake battle against money laundering and financial crime, traditional Anti-Money Laundering (AML) methods are finding themselves outpaced by the relentless innovation by criminals. However, hope is not lost! Enters Artificial Intelligence, the champion of the modern era, a technological marvel that is revolutionising the way we combat illicit financial activities.

As we dive into the ever-evolving landscape of AML solutions, it becomes apparent that staying ahead of the game requires more than just diligence; it demands adaptability, sophistication, and a level of precision only AI can deliver.

What Does AML Compliance Entail?

AML compliance serves as the cornerstone of protecting the integrity of the financial world by preventing the infiltration of illegal funds into the legitimate economy. This is especially vital for organisations facing regulatory oversight, such as banks, financial firms, and money service businesses. Building strong AML programmes, which include clear policies and procedures, thorough training, and advanced technology, is essential for meeting compliance requirements and instilling trustworthiness in day-to-day operations.

What is the Significance of AML Compliance?

To understand how to improve your AML operations, you need to first recognise why AML compliance matters so much. AML rules are in place to make it tough for criminals to enjoy their illegal money without consequences. Since most crimes involve making money from unlawful activities, stopping these ill-gotten gains is a powerful way to reduce corruption, tax evasion, theft, fraud, and many other crimes. If we don’t control these illegal profits, they could be used for more positive purposes, like improving society and people’s lives.

In simpler terms, AML compliance isn’t just an extra thing to do or a hassle. It’s a fundamental requirement that’s essential for a fair and well-functioning society. It’s crucial that everyone in charge of your finances and business strategies understands and respects the real value of AML compliance in maintaining a clean and trustworthy financial system.

The BFSI sector’s dominance in the market, coupled with the increasing use of digital banking services and the complexity of its transactions, has made AML solutions a vital component for managing risks and ensuring compliance in this sector. These solutions are essential in the ongoing effort to combat financial crimes and protect the integrity of the financial system.

The Need for Effective AML Solution

At the heart of the problem is the challenge in rapidly accessing large volumes of data. Today, many financial institutions are using data systems that weren’t designed to handle the vast amount of data and analysis needed for AML. Fortunately, there are now various market solutions available to support smart analytics in AML. These solutions include software from major companies, data analytics tools (some with specific AML features), and even large cloud service providers. These solutions save a lot of time and money by connecting different pieces of information, making conclusions, and automatically updating machine learning models.

The importance of Anti-Money Laundering (AML) Solutions cannot be overstated in today’s global financial landscape. These solutions play a pivotal role in safeguarding the integrity of financial systems. and are instrumental for several reasons.

9 Reasons to Integrate a Robust AML Solution:

Crime Deterrence: AML solutions act as a potent deterrent against financial crimes such as money laundering, terrorism financing, and fraud. Its presence makes it more difficult for criminals to exploit the financial system to legitimise their ill-gotten gains.

Regulatory Compliance: Regulatory bodies across the world mandate AML compliance for financial institutions. Adhering to these regulations not only ensures legal compliance but also helps institutions avoid hefty fines and reputational damage resulting from non-compliance.

Risk Mitigation: AML solutions aid in identifying and mitigating risks associated with engaging with potentially illicit customers or entities. By scrutinising transactions and customer profiles, they help financial institutions make informed decisions and minimise their exposure to risk.

Preserving Reputation: A reputation for financial integrity is invaluable in the banking and financial sector. AML solutions protect the reputation of financial institutions by preventing them from inadvertently being associated with criminal activities.

Financial Stability: The prevention of money laundering and other financial crimes contributes to the overall stability of the financial system. When funds are legitimate, the system functions more smoothly, benefiting businesses, individuals, and the economy as a whole.

Global Cooperation: Money laundering knows no borders. AML solutions encourage international cooperation and information sharing among financial institutions and regulatory bodies, helping to combat cross-border criminal activities effectively.

Customer Trust: AML solutions, when implemented effectively, demonstrate an institution’s commitment to protecting its customers and the financial system as a whole. This, in turn, fosters trust among clients and stakeholders.

Operational Efficiency: Modern AML solutions often incorporate advanced technologies like artificial intelligence and machine learning, enhancing operational efficiency. They automate the process of monitoring and detecting suspicious activities, saving time and resources.

Reduction in Investigative Costs: By automating the initial stages of risk assessment and anomaly detection, AML solutions reduce the workload of human investigators. This leads to a more efficient allocation of resources for in-depth investigations where they are most needed.

In a nutshell, AML solutions are indispensable tools in the fight against financial crimes and the protection of the global financial system. Their importance extends far beyond mere regulatory compliance, encompassing crime prevention, risk management, and the preservation of trust and financial stability.

Enhancing Global Banking Security: KiyaAI’s AML Solution in Action

In today’s global financial landscape, staying one step ahead of money launderers and financial criminals is paramount. To safeguard your institution’s integrity and regulatory compliance, a powerful Anti-Money Laundering (AML) solution is crucial. KiyaAI’s AML Solution comes equipped with a comprehensive set of features designed to tackle the evolving challenges of financial crime effectively.

Explore the key features that make our AML solution a standout choice for financial institutions.

1. Comprehensive Risk-Based Approach: KiyaAI’s AML Solution employs robust data analytics to monitor and evaluate both online and offline transactions. It integrates risk scoring to specific customers, accounts, and transactions, ensuring that potential threats are identified and assessed with precision. By adopting a risk-based approach, global financial institutions get to focus its resources where they matter most, optimising their AML efforts.

2. Customisable Solution: Adapting to changing regulatory landscapes is essential for AML compliance. With KiyaAI’s solution, banks can effortlessly select, update, and monitor company policies to keep a vigilant eye on suspicious and unusual behaviour. This ensures that the institution remains agile in promptly responding to forthcoming risks and regulations, all while maintaining a robust compliance framework.

3. Interactive Dashboard: KiyaAI’s AML Solution offers an intuitive and interactive dashboard equipped with in-built data visualisation technology. This feature empowers the global organisations to gain a complete understanding of each case and make informed decisions. Visual representations of data enable quick and effective responses, helping the company stay in control of its institution’s AML efforts.

4. Fully Integrated Reporting: KiyaAI’s solution offers a fully integrated audit trails and reporting tool that simplify the often-complex task of regulatory reporting and allows businesses to confidently adhere to regulations and streamline their compliance processes.

5. Advanced Customer Profiling for Due Diligence: KiyaAI AML Solution goes beyond transaction monitoring by collecting comprehensive customer details, including KYC information, account history, transaction data, and relationship details. This 360-degree customer profile aids in comprehensive due diligence, ensuring that one has all the necessary information to identify potential risks.

6. Automated Customer Re-verification: Efficiently manage customer re-verification with the automated system, which utilises both static and dynamic parameters. This approach helps detect anomalies and eliminate threats by periodically assessing customer profiles, reducing the risk of illicit activity going undetected.

7. Real-time Transaction Surveillance: Round-the-clock transaction monitoring is crucial in today’s fast-paced financial world. KiyaAI’s AML Solution employs robust AI and ML technologies to analyse local and cross-border transactions in real-time, enabling the swift identification of suspicious activities.

8. Alert Investigation and Case Management: Integrated with end-to-end alert and case management, the intelligent AML solution provides violation details for seamless investigation and ease of access decision making. Built-in with workload balancing, alert prioritisation and customised maker-checker workflow, KiyaAI AML simplifies and accelerates case allocation and investigation.

9. Global Regulatory Compliance: KiyaAI’s AML Solutions guarantee compliance with global AML regulations, offering regular updates and adaptability for new requirements. It helps organisations stay ahead of evolving laws effortlessly, ensuring seamless operations across borders and minimising compliance risks.

Kiya.ia’s AML Solution offers a comprehensive suite of features designed to empower global institutions in the fight against financial crime. By adopting a risk-based approach, customisable rules, interactive dashboards, and comprehensive customer profiling, the organisations get to strengthen its AML strategy and stay compliant with evolving regulations. With real-time transaction surveillance and integrated watchlist screening, the firm can be confident in its ability to detect and prevent illicit financial activities.