Navigating the Complexities of FATCA and CRS

In the constant battle against tax evasion, global tax transparency is now recognised as a top priority for tax authorities and governments alike. For close to ten years, tax authorities and lawmakers worldwide have been actively promoting global tax transparency and combating tax evasion. The United States pioneered this movement by enacting the Foreign Account Tax Compliance Act (FATCA) in 2010. FATCA primarily concentrates on US residents and citizens who own assets in foreign nations but fail to declare them on their US tax returns. Despite some early opposition, FATCA has evolved as a model for equivalent laws to be adopted internationally, demonstrating a significant shift towards greater global financial accountability.

Quick Insight Alert!

The Organisation for Economic Co-operation and Development’s (OECD) Base Erosion and Profit Shifting (BEPS) frameworks have helped spark a dramatic shift in corporate tax transparency since 2013.

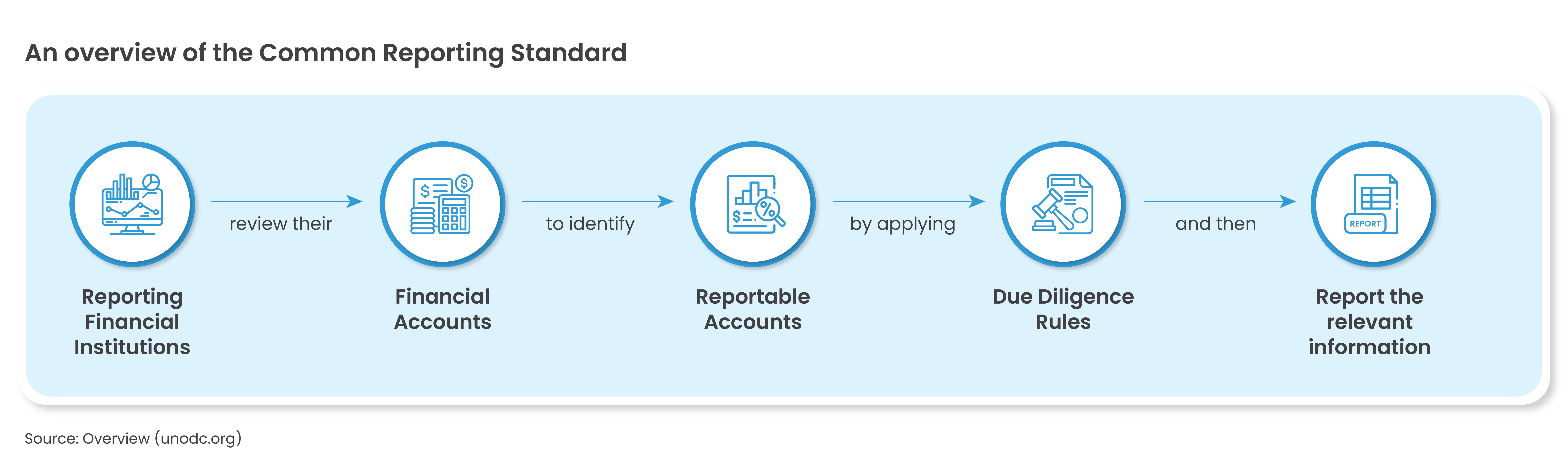

Furthermore, in 2014, the Organisation for Economic Co-operation and Development (OECD), renowned for its longstanding advocacy for tax transparency, took a significant step forward by endorsing its own global counterpart to FATCA, termed the Common Reporting Standard (CRS). This development underscores the continued commitment to combatting tax evasion and promoting financial integrity on a global scale.

Facilitating Taxpayer Information Exchange

The effective exchange of taxpayer information enabled by FATCA and CRS largely depends on financial institutions such as banks, custodians, asset managers, stated fund types, and insurance firms. These organisations are required to collect, analyse, and report information about their account holders/investors. Ultimately, this information is sent to the tax authorities in the corresponding country where each account holder/investor has been identified as a tax resident.

The Fundamental Aspect and Complexities of FATCA & CRS Compliance Programme

- Insufficiency of Current Customer Data: Despite robust AML and KYC processes, Financial Institutions (FIs) encounter indications that their existing data may be inadequate.

- Challenges in Data Collection and Management: FIs struggle with data collected from third parties, often manually and lacking crucial details such as tax residency or identification numbers. This data, stored without proper review or verification, poses challenges not only in cybersecurity but also in compliance with data protection regulations like GDPR.

- Complexity of Compliance Regulations: Managing the myriad rules and regulations governing data collection, exemplified by the intricate standards of the OECD’s CRS, remains a primary issue. While over 100 Competent Authorities agree on the same set of rules, variations in implementation result in a constantly evolving patchwork of compliance requirements.

- Risks and Penalties of Non-Compliance: Non-compliance poses substantial risks, with Competent Authorities empowered to impose hefty fines and penalties. Examples include fines reaching up to A$500,000 in Australia and significant penalties announced in jurisdictions like the British Virgin Islands (BVI) and Cayman Islands.

- Reputational Damage: Beyond financial repercussions, non-compliance carries the threat of severe reputational harm. FIs risk being associated with aiding tax evasion or intentionally evading regulations, leading to damage to their reputation and trustworthiness.

FATCA & CRS Reporting Solution:

Amidst the challenges faced by Financial Institutions (FIs) in managing data for regulatory compliance, KiyaAI‘s solution provides a reliable platform for ensuring compliance with FATCA and CRS standards. Despite indications of insufficient data and the complexity of compliance regulations, our solution offers centralised management, uniform processes, and worldwide coverage of reporting needs. With KiyaAI, businesses can stay ahead of evolving regulations, maintain thorough audit trails, and elevate their reputations while streamlining operations and minimising disruptions. KiyaAI’s comprehensive Reporting & Documentation tool – The FATCA & CRS Reporting Solution aims at simplifying the tax compliance journey while alleviating the complexities associated with crafting and executing new compliance protocols. It also helps businesses enhance operational efficiency, diminish resource demands, and achieve cost savings by streamlining processes with our robust solution. Trusted by global enterprises, our FATCA & CRS Reporting Solution elevates reputations and client service benchmarks. Regardless of the trajectory of evolving legislation, our solution minimises organisational disruptions, fortifies compliance Programs, and guarantees adherence to filing requirements for years to come.

What to expect?

- Centralised Reporting Management

- Uniform Process and Oversight

- Worldwide Coverage of Reporting Needs

- Keeping Abreast of Current Regulations

- Thorough Audit Trail

In the constant battle against tax evasion, global tax transparency is now recognised as a top priority for tax authorities and governments alike. For close to ten years, tax authorities and lawmakers worldwide have been actively promoting global tax transparency and combating tax evasion. The United States pioneered this movement by enacting the Foreign Account Tax Compliance Act (FATCA) in 2010. FATCA primarily concentrates on US residents and citizens who own assets in foreign nations but fail to declare them on their US tax returns. Despite some early opposition, FATCA has evolved as a model for equivalent laws to be adopted internationally, demonstrating a significant shift towards greater global financial accountability.

Quick Insight Alert!

The Organisation for Economic Co-operation and Development’s (OECD) Base Erosion and Profit Shifting (BEPS) frameworks have helped spark a dramatic shift in corporate tax transparency since 2013.

Furthermore, in 2014, the Organisation for Economic Co-operation and Development (OECD), renowned for its longstanding advocacy for tax transparency, took a significant step forward by endorsing its own global counterpart to FATCA, termed the Common Reporting Standard (CRS). This development underscores the continued commitment to combatting tax evasion and promoting financial integrity on a global scale.

Facilitating Taxpayer Information Exchange

The effective exchange of taxpayer information enabled by FATCA and CRS largely depends on financial institutions such as banks, custodians, asset managers, stated fund types, and insurance firms. These organisations are required to collect, analyse, and report information about their account holders/investors. Ultimately, this information is sent to the tax authorities in the corresponding country where each account holder/investor has been identified as a tax resident.

The fundamental aspect and complexities of FATCA/ CRS compliance programme

- Insufficiency of Current Customer Data: Despite robust AML and KYC processes, Financial Institutions (FIs) encounter indications that their existing data may be inadequate.

- Challenges in Data Collection and Management: FIs struggle with data collected from third parties, often manually and lacking crucial details such as tax residency or identification numbers. This data, stored without proper review or verification, poses challenges not only in cybersecurity but also in compliance with data protection regulations like GDPR.

- Complexity of Compliance Regulations: Managing the myriad rules and regulations governing data collection, exemplified by the intricate standards of the OECD’s CRS, remains a primary issue. While over 100 Competent Authorities agree on the same set of rules, variations in implementation result in a constantly evolving patchwork of compliance requirements.

- Risks and Penalties of Non-Compliance: Non-compliance poses substantial risks, with Competent Authorities empowered to impose hefty fines and penalties. Examples include fines reaching up to A$500,000 in Australia and significant penalties announced in jurisdictions like the British Virgin Islands (BVI) and Cayman Islands.

- Reputational Damage: Beyond financial repercussions, non-compliance carries the threat of severe reputational harm. FIs risk being associated with aiding tax evasion or intentionally evading regulations, leading to damage to their reputation and trustworthiness.

FATCA & CRS Reporting Solution:

Amidst the challenges faced by Financial Institutions (FIs) in managing data for regulatory compliance, KiyaAI’s solution provides a reliable platform for ensuring compliance with FATCA and CRS standards. Despite indications of insufficient data and the complexity of compliance regulations, our solution offers centralised management, uniform processes, and worldwide coverage of reporting needs. With KiyaAI, businesses can stay ahead of evolving regulations, maintain thorough audit trails, and elevate their reputations while streamlining operations and minimising disruptions. KiyaAi’s comprehensive Reporting & Documentation tool – The FATCA & CRS Reporting Solution aims at simplifying the tax compliance journey while alleviating the complexities associated with crafting and executing new compliance protocols. It also helps businesses enhance operational efficiency, diminish resource demands, and achieve cost savings by streamlining processes with our robust solution. Trusted by global enterprises, our FATCA & CRS Reporting Solution elevates reputations and client service benchmarks. Regardless of the trajectory of evolving legislation, our solution minimises organisational disruptions, fortifies compliance Programs, and guarantees adherence to filing requirements for years to come.

What to expect?

- Centralised Reporting Management

- Uniform Process and Oversight

- Worldwide Coverage of Reporting Needs

- Keeping Abreast of Current Regulations

- Thorough Audit Trail