12 Influential Factors Shaping Digital Transformation in Trade Finance

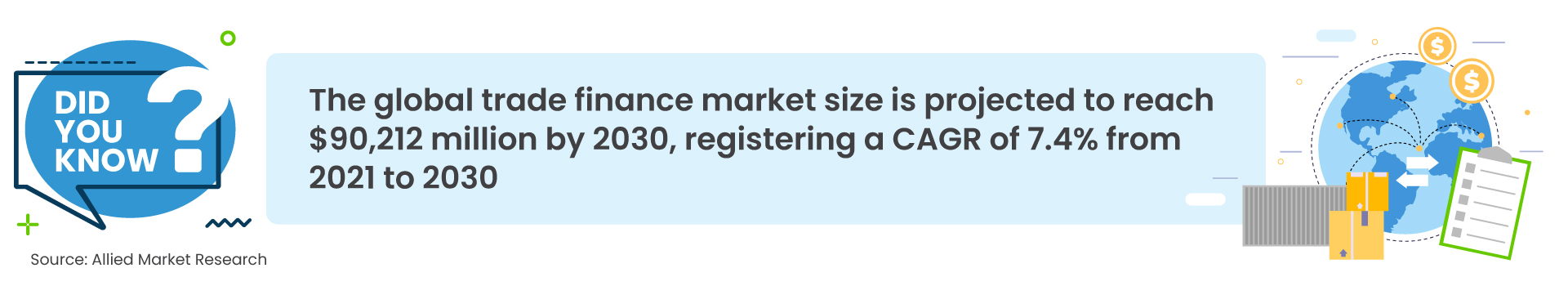

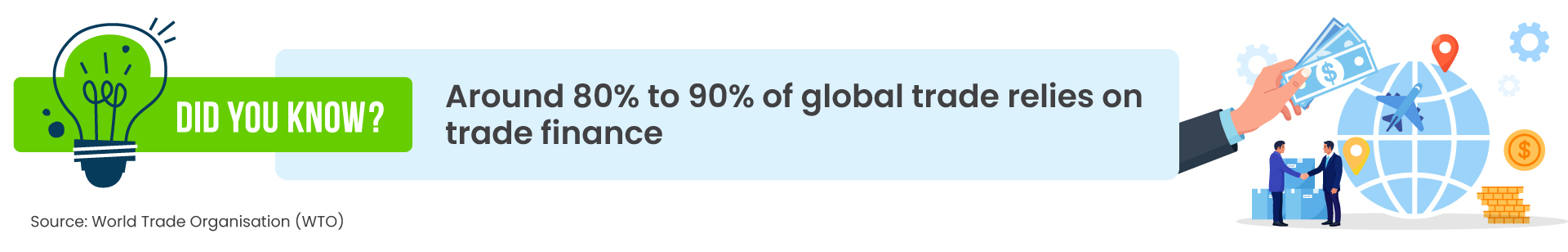

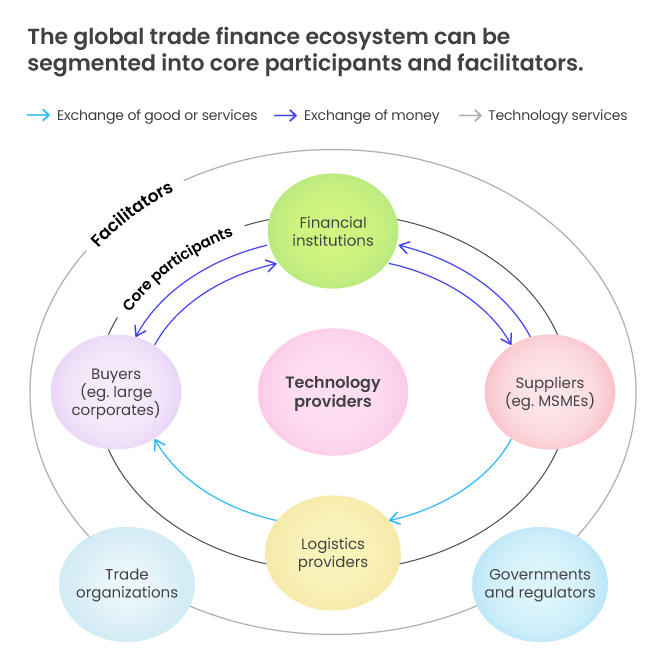

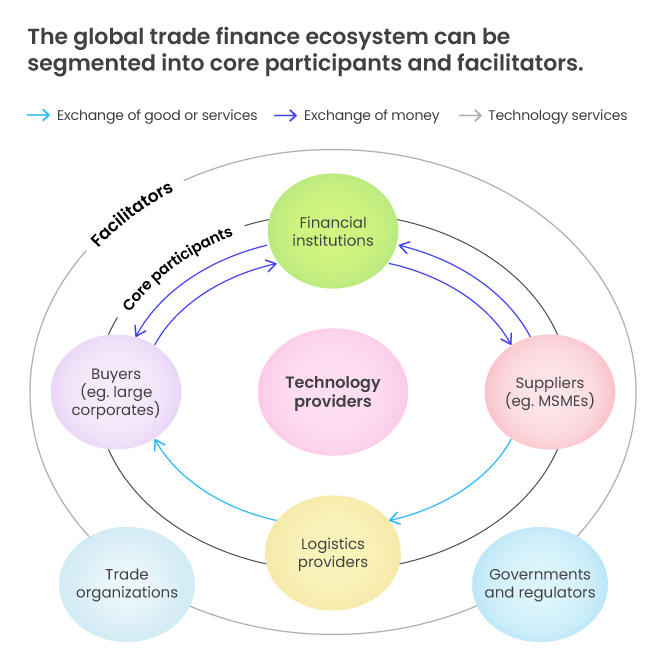

Trade Finance is a crucial aspect for banks and financial institutions, often seen as a safe form of lending essential for international trade. It involves various financial products and tools that help businesses conduct global commerce by managing payment and supply risks. Despite its importance, many Micro, Small, and Medium-sized Enterprises (MSMEs) struggle to access these services. However, there’s a growing recognition towards modernisation and inclusion in trade finance. This means adopting digital tools, collaborative networks, and following standardised practices. These initiatives reflect a joint commitment from various stakeholders, particularly banks, to elevate the efficiency and accessibility of trade finance solutions, thus fostering a more inclusive and resilient global trade landscape.

In response to the intensifying demands for trade finance in today’s competitive market, banks and financial institutions are compelled to undergo transformative changes. Recognising the necessity of digital transformation to streamline operations, a comprehensive trade finance solution becomes imperative. This solution should encompass robust risk management and reporting capabilities, facilitating seamless transactions for multiple entities. Compliance with global trade standards ensures interoperability across borders, enhancing efficiency in international trade operations.

Within the comprehensive suite of Trade Finance Solutions, a range of powerful tools is available to streamline and enhance banking operations. These solutions include Regulatory & Compliance Solution, a Loan Management System for efficient loan processing, a SWIFT Engine for secure communication and payments handling, a robust Core Banking Solution to elevate overall banking operations, a Data Management System to leverage data-driven insights, and a Loan Origination System for simplified loan origination processes. Together, these solutions empower financial institutions to effectively navigate the complexities of trade finance, ensuring efficiency, compliance, and customer satisfaction throughout the entire process.

12 Essential Aspects of Digital Trade Finance Solutions Empowering Banking

In today’s dynamic financial landscape, trade finance solutions play an important role in empowering the banking industry to meet the evolving needs of businesses engaged in international trade. Here’s how these solutions streamline operations, enhance efficiency, and drive growth for banks and financial institutions.

- Customised Templates: By offering streamlined processes with customer-specific templates for various trade finance instruments, banks can tailor their services to meet the unique requirements of each client.

- Standardised Terms & Conditions: Efficient management of Bank Guarantees (BG) and Letters of Credit (LC) is achieved through parameterised terms and conditions, ensuring consistency and accuracy in transaction handling.

- Financial and Non-Financial Messages: Seamless communication and payments handling over SWIFT, including MT/MX conversion, enable smooth transactions both within and between banks.

- Omnichannel Services: Integration with a wide range of omnichannel services allows customers to manage trade finance activities conveniently through mobile and internet platforms, enhancing accessibility and user experience.

- Margin Management: Workflow-based lifecycle management for pre- and post-shipment credits ensures optimised margins across products, currencies, and business events, enabling banks to maximise returns while minimising risks.

- Full Lifecycle Management: Comprehensive management of invoices and credit notes, from issuance to closure, supports working capital finance instruments, Letter of Credits and guarantees, streamlining processes and enhancing transparency.

- Configurable Workflow Automation: Increased productivity is achieved through predefined automated workflows and user-modifiable processes aligned with SWIFT tag and field names, reducing manual errors and training requirements.

- Automated Workflow with AI/ML: AI/ML-driven automated workflows for remittance processing against shipments enhance operational efficiency,enabling banks to handle transactions more effectively and accurately.

- 360-Degree View: Analytics providing a holistic 360-degree view of trade operations, currency liquidity, and customer portfolios empower banks to make informed decisions and optimise their strategies.

- Integration to Core Systems: Seamless integration with core banking systems enhances operational efficiency, enabling banks to streamline processes and improve data accuracy.

- Islamic Trade Instruments Handling: Tailored support for handling Islamic trade instruments ensures compliance with Sharia principles, expanding the scope of services offered by banks and catering to diverse customer needs.

- Cloud-Native, Microservices, DevSecOps Framework with AI/ML: Leveraging a cutting-edge framework enriched with AI/ML models for decision-making and automation, banks can enhance security, scalability, and agility in their trade finance operations, driving innovation and competitiveness in the industry.

As banks and financial institutions embrace transformative technologies and practices, they not only enhance their own operations but also empower businesses, particularly MSMEs, to participate more effectively in international trade. By fostering inclusivity, resilience, and efficiency, these innovative solutions pave the way for a brighter future of global commerce. Through continued collaboration and innovation, the banking industry is well-positioned to navigate the complexities of trade finance and drive economic growth on a global scale.

Trade Finance is a crucial aspect for banks and financial institutions, often seen as a safe form of lending essential for international trade. It involves various financial products and tools that help businesses conduct global commerce by managing payment and supply risks. Despite its importance, many Micro, Small, and Medium-sized Enterprises (MSMEs) struggle to access these services. However, there’s a growing recognition towards modernisation and inclusion in trade finance. This means adopting digital tools, collaborative networks, and following standardised practices. These initiatives reflect a joint commitment from various stakeholders, particularly banks, to elevate the efficiency and accessibility of trade finance solutions, thus fostering a more inclusive and resilient global trade landscape.

In response to the intensifying demands for trade finance in today’s competitive market, banks and financial institutions are compelled to undergo transformative changes. Recognising the necessity of digital transformation to streamline operations, a comprehensive trade finance solution becomes imperative. This solution should encompass robust risk management and reporting capabilities, facilitating seamless transactions for multiple entities. Compliance with global trade standards ensures interoperability across borders, enhancing efficiency in international trade operations.

Within the comprehensive suite of Trade Finance Solutions, a range of powerful tools is available to streamline and enhance banking operations. These solutions include Regulatory & Compliance Solution, a Loan Management System for efficient loan processing, a SWIFT Engine for secure communication and payments handling, a robust Core Banking Solution to elevate overall banking operations, a Data Management System to leverage data-driven insights, and a Loan Origination System for simplified loan origination processes. Together, these solutions empower financial institutions to effectively navigate the complexities of trade finance, ensuring efficiency, compliance, and customer satisfaction throughout the entire process.

12 Essential Aspects of Digital Trade Finance Solutions Empowering Banking

In today’s dynamic financial landscape, trade finance solutions play an important role in empowering the banking industry to meet the evolving needs of businesses engaged in international trade. Here’s how these solutions streamline operations, enhance efficiency, and drive growth for banks and financial institutions.

- Customised Templates: By offering streamlined processes with customer-specific templates for various trade finance instruments, banks can tailor their services to meet the unique requirements of each client.

- Standardised Terms & Conditions: Efficient management of Bank Guarantees (BG) and Letters of Credit (LC) is achieved through parameterised terms and conditions, ensuring consistency and accuracy in transaction handling.

- Financial and Non-Financial Messages: Seamless communication and payments handling over SWIFT, including MT/MX conversion, enable smooth transactions both within and between banks.

- Omnichannel Services: Integration with a wide range of omnichannel services allows customers to manage trade finance activities conveniently through mobile and internet platforms, enhancing accessibility and user experience.

- Margin Management: Workflow-based lifecycle management for pre- and post-shipment credits ensures optimised margins across products, currencies, and business events, enabling banks to maximise returns while minimising risks.

- Full Lifecycle Management: Comprehensive management of invoices and credit notes, from issuance to closure, supports working capital finance instruments, Letter of Credits and guarantees, streamlining processes and enhancing transparency.

- Configurable Workflow Automation: Increased productivity is achieved through predefined automated workflows and user-modifiable processes aligned with SWIFT tag and field names, reducing manual errors and training requirements.

- Automated Workflow with AI/ML: AI/ML-driven automated workflows for remittance processing against shipments enhance operational efficiency,enabling banks to handle transactions more effectively and accurately.

- 360-Degree View: Analytics providing a holistic 360-degree view of trade operations, currency liquidity, and customer portfolios empower banks to make informed decisions and optimise their strategies.

- Integration to Core Systems: Seamless integration with core banking systems enhances operational efficiency, enabling banks to streamline processes and improve data accuracy.

- Islamic Trade Instruments Handling: Tailored support for handling Islamic trade instruments ensures compliance with Sharia principles, expanding the scope of services offered by banks and catering to diverse customer needs.

- Cloud-Native, Microservices, DevSecOps Framework with AI/ML: Leveraging a cutting-edge framework enriched with AI/ML models for decision-making and automation, banks can enhance security, scalability, and agility in their trade finance operations, driving innovation and competitiveness in the industry.

As banks and financial institutions embrace transformative technologies and practices, they not only enhance their own operations but also empower businesses, particularly MSMEs, to participate more effectively in international trade. By fostering inclusivity, resilience, and efficiency, these innovative solutions pave the way for a brighter future of global commerce. Through continued collaboration and innovation, the banking industry is well-positioned to navigate the complexities of trade finance and drive economic growth on a global scale.