The Future of Banking with Open Finance

Open finance is reshaping the financial services sector by expanding the principles of open banking to include a wider range of financial products and services. This innovative approach empowers individuals and promotes inclusivity by granting businesses and customers greater ownership and control over their financial data. The result is enhanced access to a broader range of financial services, improved decision-making, and more personalised experiences.

The main purpose of open finance is to leverage technology to foster an inclusive, innovative, and customer-centric financial ecosystem. It facilitates the seamless exchange of data between financial institutions and third-party providers through secure APIs, ensuring data privacy and protection while promoting a competitive and collaborative environment among financial service providers.

The Evolution and Impact of Open Finance

Today it is safe to declare that open finance is a transformative force. It addresses the increasing demand for transparency, efficiency, and personalised financial services.

Open finance also significantly fuels innovation. It enables startups and established financial institutions alike to develop new products and services tailored to the unique needs of their customers. This not only improves user experiences but also drives economic growth by ensuring more efficient allocation of capital and resources.

Along with this, open finance enhances financial literacy and empowers individuals with a comprehensive view of their financial data. By providing context to everyday transactions, it helps customers make informed decisions, plan for their future, and manage their finances with greater confidence.

Open finance not just represents technological progress, but also signifies a cultural shift towards a more open, transparent, and customer-focused financial world.

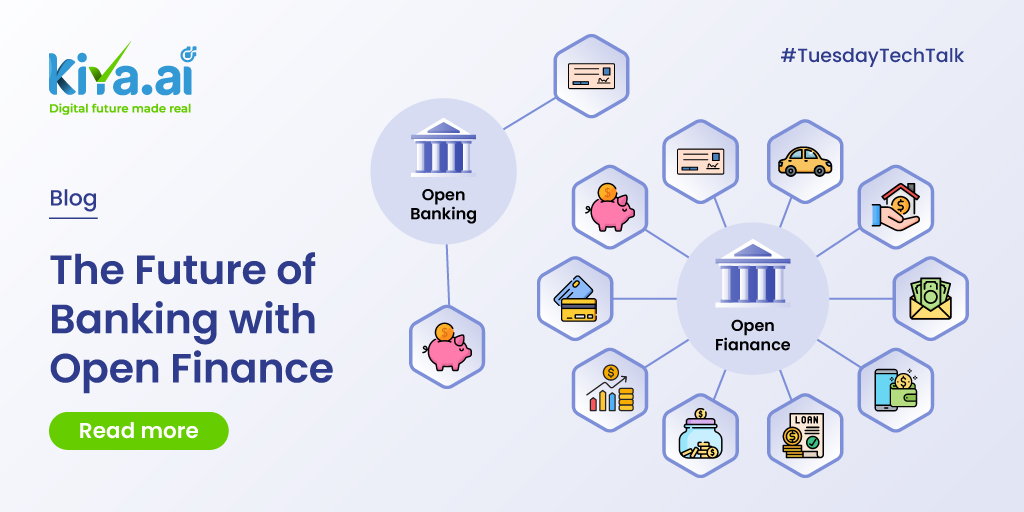

OPEN BANKING VS. OPEN FINANCE

| Open Banking | Open Finance |

|

Scope and Focus |

|

| Limited to data related to payment accounts and transactional information. Focuses on improving payment processes and customer control over banking data | Extends to a wide range of financial products and services. Aims to provide a comprehensive view of an individual’s financial situation. |

|

Customer Empowerment |

|

| Provides greater control over banking data and facilitates smoother payment processes. | Offers holistic financial management, allowing customers to make informed decisions across all financial products and services. |

| Drives innovation primarily within the banking sector. | Promotes innovation across the entire financial ecosystem, benefiting both startups and established financial institutions. |

Use Case: Transforming Financial Access with Open Finance

Imagine a freelancer in Brazil who, until recently, struggled with high fees when sending money to family abroad. With the emergence of fintech and open finance, these barriers have diminished. Today, using a digital platform, he can send funds globally at minimal cost and in real-time, ensuring his family receives support without financial strain.

Open finance facilitates seamless transactions like these by integrating financial services across borders and offering personalised solutions. It empowers individuals worldwide to manage their finances efficiently and access affordable services tailored to their specific needs.

Maximise Business Potential with Open Finance

- Innovating Financial Solutions

Open finance provides an open ground for innovation, enabling businesses and institutions to develop new services through cross-industry collaboration, API-driven ecosystems, and customised offerings. Partnerships across sectors like insurance, fintech, and pension funds foster collaborative innovation, while APIs create a more interconnected financial ecosystem. This access to data allows financial institutions to tailor bespoke services to specific market segments or individual customers.

- Transforming Customer Experience

The customer journey is significantly improved by open finance, leading to higher satisfaction through seamless integration, real-time data access, and streamlined processes. Customers can manage multiple financial accounts in one place, stay informed with real-time data, and experience reduced friction and wait times from onboarding to support, resulting in a more efficient and convenient experience.

- Personalising Financial Services through Data

Open finance enables deep insights into customer behaviour, allowing businesses to tailor financial solutions and enhance risk management and targeted marketing. Analysing transaction data helps businesses understand demand and develop in response to real customer needs. Enhanced data improves risk assessment, and financial data insights support targeted marketing efforts, ensuring customers receive relevant solutions and offers. Embracing open finance leads to higher growth and deeper customer loyalty.

Empower Consumers Through Open Finance

- Expanded Access to Financial Products and Services:

Open finance broadens the horizon for consumers by leveraging the interconnectedness of financial systems and data sharing through APIs. Customers can manage multiple financial accounts from various institutions in one place, simplifying the process of tracking their financial activities and providing a holistic view of their financial health. With this financial service providers can also offer personalised products that align with individuals’ financial situations.

- Enhanced Financial Management and Planning:

Advanced categorisation, planning, and analytics tools help customers understand their spending habits, adjust their budgets, and track income and recurring expenses in real-time. This comprehensive insight into financial health supports better planning and risk management, allowing customers to improve their financial stability.

- Empowered Control Over Financial Data:

Open finance gives people more power over their financial data, emphasising data ownership and consent. Customers have the right to control access to their financial information, ensuring transparency and security throughout the data-sharing process. They can grant or revoke access to their data at any time, maintaining ultimate authority over their personal information.

Three Significant Milestones

- Creates New Financial Ecosystems

Financial ecosystems enable the creation of new marketplaces and economies through open-finance technology, empowering businesses with diverse revenue streams through enhanced competition, collaboration, and innovation. By leveraging advanced technology, institutions can improve operational efficiency and swiftly adapt to evolving customer needs, thereby boosting profitability, customer satisfaction, and loyalty. The ecosystem approach fosters connectivity, facilitating seamless integration of innovation, expertise, and customer-centric capabilities.

- Enables Economic Empowerment

Open finance has the potential to drive positive societal change by leveraging technology to reduce biases and foster a more progressive future. By bridging economic gaps, it empowers the unbanked and underbanked, lifting individuals out of poverty and providing pathways to savings, wealth creation, and financial management. This transformation champions financial inclusion through enhanced digitisation and interconnected ecosystems, democratising access to banking services across diverse socio-economic segments and niche markets overlooked by traditional banking systems. Moreover, open finance lowers the cost to serve, making emerging markets more viable for financial institutions. It also fuels economic development by facilitating technologies like point-of-sale loans for small businesses, stimulating sales, production, and employment, thereby cultivating a dynamic environment of growth and prosperity.

- Supports Sustainable Decision-Making

Open finance is instrumental in driving sustainable decision-making within financial services by facilitating seamless connections between capital and impactful initiatives. It enhances access to diverse datasets through OpenAPIs, enabling financial institutions to comply with regulations effectively and gain deeper insights into their risks and positions, thereby fostering sustainable growth. Moreover, open finance supports impact investing by directing funds towards green initiatives, ensuring investments contribute positively to both financial returns and environmental sustainability. It also digitises trade supply chains, promoting inclusivity and transparency in global commerce by verifying the origins of eco-friendly goods and bridging the trade-finance gap. This digital infrastructure facilitates AI-driven credit decisions based on real-time transaction data, benefiting MSMEs and offering sustainability-linked products to support their transition to environmentally responsible practices while reducing operational costs.

With this, we are safe to say that open finance stands poised as the catalyst for future innovation and growth within the financial services sector, fostering dynamic collaborations between banks and fintechs to pioneer new products and revenue channels. By embracing partnerships with fintechs, banks not only reduce risks and simplify onboarding processes but also enhance their appeal to a broader customer base. This collaborative synergy is expected to drive groundbreaking fintech innovations such as income share agreements and cutting-edge digital currency services. As open finance technology continues to evolve alongside user expectations, consumer behavior will pivot towards faster, more secure, and convenient financial interactions, accelerating the adoption of fintech solutions like real-time bank payments and Buy Now, Pay Later (BNPL) services. Moreover, open finance presents a strategic opportunity for large enterprises to reimagine themselves as fintech leaders, leveraging tools such as embedded payments to expand their capabilities and market reach.

Ready to explore the future of finance?

Open finance is reshaping the financial services sector by expanding the principles of open banking to include a wider range of financial products and services. This innovative approach empowers individuals and promotes inclusivity by granting businesses and customers greater ownership and control over their financial data. The result is enhanced access to a broader range of financial services, improved decision-making, and more personalised experiences.

The main purpose of open finance is to leverage technology to foster an inclusive, innovative, and customer-centric financial ecosystem. It facilitates the seamless exchange of data between financial institutions and third-party providers through secure APIs, ensuring data privacy and protection while promoting a competitive and collaborative environment among financial service providers.

The Evolution and Impact of Open Finance

Today it is safe to declare that open finance is a transformative force. It addresses the increasing demand for transparency, efficiency, and personalised financial services.

Open finance also significantly fuels innovation. It enables startups and established financial institutions alike to develop new products and services tailored to the unique needs of their customers. This not only improves user experiences but also drives economic growth by ensuring more efficient allocation of capital and resources.

Along with this, open finance enhances financial literacy and empowers individuals with a comprehensive view of their financial data. By providing context to everyday transactions, it helps customers make informed decisions, plan for their future, and manage their finances with greater confidence.

Open finance not just represents technological progress, but also signifies a cultural shift towards a more open, transparent, and customer-focused financial world.

OPEN BANKING VS. OPEN FINANCE

| Open Banking | Open Finance |

|

Scope and Focus |

|

| Limited to data related to payment accounts and transactional information. Focuses on improving payment processes and customer control over banking data | Extends to a wide range of financial products and services. Aims to provide a comprehensive view of an individual’s financial situation. |

|

Customer Empowerment |

|

| Provides greater control over banking data and facilitates smoother payment processes. | Offers holistic financial management, allowing customers to make informed decisions across all financial products and services. |

| Drives innovation primarily within the banking sector. | Promotes innovation across the entire financial ecosystem, benefiting both startups and established financial institutions. |

Use Case: Transforming Financial Access with Open Finance

Imagine a freelancer in Brazil who, until recently, struggled with high fees when sending money to family abroad. With the emergence of fintech and open finance, these barriers have diminished. Today, using a digital platform, he can send funds globally at minimal cost and in real-time, ensuring his family receives support without financial strain.

Open finance facilitates seamless transactions like these by integrating financial services across borders and offering personalised solutions. It empowers individuals worldwide to manage their finances efficiently and access affordable services tailored to their specific needs.

Maximise Business Potential with Open Finance

- Innovating Financial Solutions

Open finance provides an open ground for innovation, enabling businesses and institutions to develop new services through cross-industry collaboration, API-driven ecosystems, and customised offerings. Partnerships across sectors like insurance, fintech, and pension funds foster collaborative innovation, while APIs create a more interconnected financial ecosystem. This access to data allows financial institutions to tailor bespoke services to specific market segments or individual customers.

- Transforming Customer Experience

The customer journey is significantly improved by open finance, leading to higher satisfaction through seamless integration, real-time data access, and streamlined processes. Customers can manage multiple financial accounts in one place, stay informed with real-time data, and experience reduced friction and wait times from onboarding to support, resulting in a more efficient and convenient experience.

- Personalising Financial Services through Data

Open finance enables deep insights into customer behaviour, allowing businesses to tailor financial solutions and enhance risk management and targeted marketing. Analysing transaction data helps businesses understand demand and develop in response to real customer needs. Enhanced data improves risk assessment, and financial data insights support targeted marketing efforts, ensuring customers receive relevant solutions and offers. Embracing open finance leads to higher growth and deeper customer loyalty.

Empower Consumers Through Open Finance

- Expanded Access to Financial Products and Services:

Open finance broadens the horizon for consumers by leveraging the interconnectedness of financial systems and data sharing through APIs. Customers can manage multiple financial accounts from various institutions in one place, simplifying the process of tracking their financial activities and providing a holistic view of their financial health. With this financial service providers can also offer personalised products that align with individuals’ financial situations.

- Enhanced Financial Management and Planning:

Advanced categorisation, planning, and analytics tools help customers understand their spending habits, adjust their budgets, and track income and recurring expenses in real-time. This comprehensive insight into financial health supports better planning and risk management, allowing customers to improve their financial stability.

- Empowered Control Over Financial Data:

Open finance gives people more power over their financial data, emphasising data ownership and consent. Customers have the right to control access to their financial information, ensuring transparency and security throughout the data-sharing process. They can grant or revoke access to their data at any time, maintaining ultimate authority over their personal information.

Three Significant Milestones

- Creates New Financial Ecosystems

Financial ecosystems enable the creation of new marketplaces and economies through open-finance technology, empowering businesses with diverse revenue streams through enhanced competition, collaboration, and innovation. By leveraging advanced technology, institutions can improve operational efficiency and swiftly adapt to evolving customer needs, thereby boosting profitability, customer satisfaction, and loyalty. The ecosystem approach fosters connectivity, facilitating seamless integration of innovation, expertise, and customer-centric capabilities.

- Enables Economic Empowerment

Open finance has the potential to drive positive societal change by leveraging technology to reduce biases and foster a more progressive future. By bridging economic gaps, it empowers the unbanked and underbanked, lifting individuals out of poverty and providing pathways to savings, wealth creation, and financial management. This transformation champions financial inclusion through enhanced digitisation and interconnected ecosystems, democratising access to banking services across diverse socio-economic segments and niche markets overlooked by traditional banking systems. Moreover, open finance lowers the cost to serve, making emerging markets more viable for financial institutions. It also fuels economic development by facilitating technologies like point-of-sale loans for small businesses, stimulating sales, production, and employment, thereby cultivating a dynamic environment of growth and prosperity.

- Supports Sustainable Decision-Making

Open finance is instrumental in driving sustainable decision-making within financial services by facilitating seamless connections between capital and impactful initiatives. It enhances access to diverse datasets through OpenAPIs, enabling financial institutions to comply with regulations effectively and gain deeper insights into their risks and positions, thereby fostering sustainable growth. Moreover, open finance supports impact investing by directing funds towards green initiatives, ensuring investments contribute positively to both financial returns and environmental sustainability. It also digitises trade supply chains, promoting inclusivity and transparency in global commerce by verifying the origins of eco-friendly goods and bridging the trade-finance gap. This digital infrastructure facilitates AI-driven credit decisions based on real-time transaction data, benefiting MSMEs and offering sustainability-linked products to support their transition to environmentally responsible practices while reducing operational costs.

With this, we are safe to say that open finance stands poised as the catalyst for future innovation and growth within the financial services sector, fostering dynamic collaborations between banks and fintechs to pioneer new products and revenue channels. By embracing partnerships with fintechs, banks not only reduce risks and simplify onboarding processes but also enhance their appeal to a broader customer base. This collaborative synergy is expected to drive groundbreaking fintech innovations such as income share agreements and cutting-edge digital currency services. As open finance technology continues to evolve alongside user expectations, consumer behavior will pivot towards faster, more secure, and convenient financial interactions, accelerating the adoption of fintech solutions like real-time bank payments and Buy Now, Pay Later (BNPL) services. Moreover, open finance presents a strategic opportunity for large enterprises to reimagine themselves as fintech leaders, leveraging tools such as embedded payments to expand their capabilities and market reach.

Ready to explore the future of finance?