Financial Inclusion Through Innovation in Microfinance

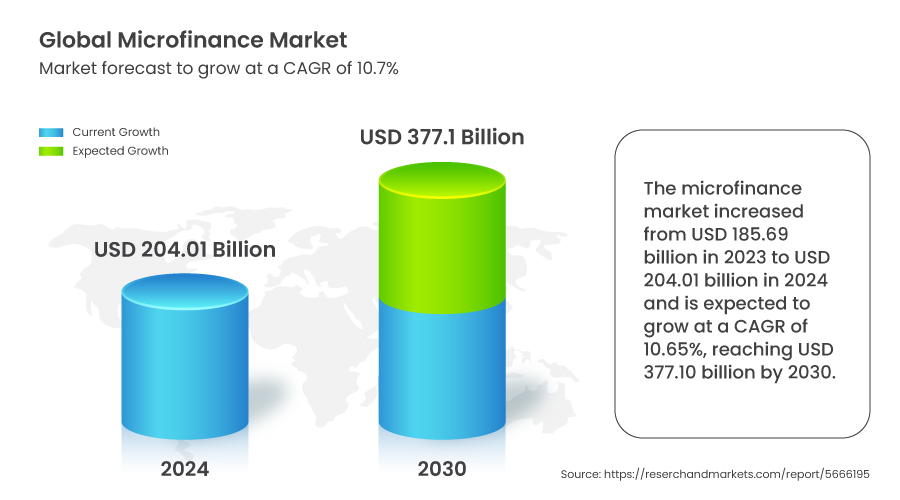

In 2022, the global microfinance market reached a staggering valuation of over $182 billion. Despite this substantial figure, a significant segment of the world’s population remains excluded from formal banking services. According to the World Bank, approximately 1.4 billion adults worldwide lack access to traditional banking, predominantly residing in rural or underserved communities.

Microfinance emerges as a pivotal solution in addressing this financial exclusion. It not only provides microloans but also essential banking services such as savings and checking accounts. These offerings empower individuals to better manage financial emergencies and improve their economic resilience. Microfinance plays a critical role in global economic dynamics, fostering financial inclusion and social progress.

Microfinance initiatives contribute extensively to poverty alleviation by offering low-income individuals the financial resources needed for income-generating activities. By enabling aspiring entrepreneurs to start or expand small enterprises, microfinance stimulates economic growth and generates employment opportunities within communities. Particularly impactful is its role in advancing gender equality, empowering women through financial independence and enhancing their decision-making capabilities.

Moreover, microfinance bridges gaps in traditional banking systems, integrating marginalised populations into the formal financial sector. By enhancing access to financial services, microfinance supports advancements in education, healthcare, and overall living standards in underserved communities worldwide. This multifaceted impact underscores the profound significance of microfinance as a tool for inclusive economic development and social transformation.

Traditional Microfinance vs. Innovative Microfinance Solutions

| Traditional Microfinance | Innovative Microfinance Solutions |

| Loan Approval Process | |

|

Traditional microfinance involves a time-consuming and paperwork-intensive loan approval process. Clients often need to visit physical branches multiple times, submit numerous documents, and wait for manual verification. This can delay access to much-needed funds.

|

Innovative microfinance solutions streamline the loan approval process through digital platforms. Automated systems, powered by AI, handle verification and approval, significantly reducing the time from application to disbursement. This ensures faster access to funds and less hassle for clients.

|

| Credit Assessment | |

|

Traditional microfinance relies on conventional credit scores and collateral to assess creditworthiness. Many low-income individuals are excluded due to lack of formal credit history or collateral, limiting their access to financial services.

|

Innovative microfinance utilises alternative data sources and AI-based credit scoring. Factors such as mobile phone usage, social media activity, and transaction history are analysed to assess creditworthiness. This inclusive approach allows more individuals, including those without traditional credit histories, to access financial services.

|

| Reach and Scalability | |

|

Traditional microfinance is often limited to local regions with physical branches, restricting its reach and scalability. Expansion requires significant investment in infrastructure and human resources.

|

Innovative microfinance solutions leverage digital technology to reach a global audience. Mobile apps and online platforms enable scalability without the need for extensive physical infrastructure. This approach allows microfinance institutions to serve a larger and more diverse client base efficiently.

|

Comprehensive Microfinance Solutions: Features and Benefits

|

Feature

|

How It Works |

| Multi-Entity and Multi-Currency Support |

Supports operations across multiple entities and currencies, ensuring seamless financial transactions in diverse environments.

|

| Customer Registration | Facilitates efficient registration for centre, group, and individual customers, accommodating various client types. |

| Lead Origination and Portfolio Management |

Offers a workflow-based lead origination system with portfolio transfer and recovery management capabilities.

|

|

Collections Management

|

Provides integrated collection management compatible with OS and mobile devices, operable in both online and offline modes.

|

|

Regulatory & MIS Reporting

|

Ensures comprehensive regulatory compliance and Management Information System (MIS) reporting for accurate and timely insights.

|

|

eCO Onboarding Platform  |

Digital platform for completing field operations, streamlining the onboarding process and enhancing field efficiency. Â |

|

|

How It Helps? |

| Enhanced Processes |

Streamlined operations through advanced features and digital integration.

|

| Reduced TAT | Significantly reduced turnaround time, improving service delivery and customer satisfaction. |

| Real-Time Reporting |

Immediate access to real-time data and analytics, enhancing decision-making and operational oversight.

|

|

Enhanced Efficiency

|

Improved operational efficiency through automation and digital solutions.

|

|

Unified Solution

|

An all-in-one platform offering a comprehensive suite of tools for managing microfinance operations.

|

|

Improved Cash Management  |

Better cash management practices through integrated collection and reporting systems  |

Kaaveri, Saadhna, and Geeta, three women from a small village in Maharashtra, India, lived below the poverty line with no access to traditional banking services. Despite their aspirations to start a business selling homemade Indian spice mixes, they struggled to secure loans.

Microfinance: A Lifeline for Aspiring Entrepreneurs

A local Microfinance Institution (MFI) provided them with small loans, enabling them to purchase raw materials and packaging. The MFI’s group registration process, multi-entity support, and digital onboarding platform streamlined their access to financial resources and reduced turnaround time.

Empowerment Through Financial Literacy and Technology

The MFI also offered financial literacy training, equipping them with the knowledge to manage their business effectively. With OS and mobile device-based collections, they could manage transactions both online and offline, ensuring uninterrupted business operations.

As their business grew, they expanded their market beyond their village. The income generated improved their living standards, allowing them to provide better education and healthcare for their families.

Today, it is estimated that microfinance’s future is being shaped by emerging trends such as blockchain, AI-driven credit scoring, and sustainability. Blockchain technology ensures secure and transparent transactions, enhancing trust in financial processes. AI-powered credit scoring provides more accurate assessments, enabling fairer access to loans for underserved populations. Emphasising sustainability, microfinance institutions are increasingly supporting eco-friendly initiatives, ensuring long-term economic and environmental benefits. Together, these innovations are creating a more inclusive and efficient microfinance ecosystem.

In 2022, the global microfinance market reached a staggering valuation of over $182 billion. Despite this substantial figure, a significant segment of the world’s population remains excluded from formal banking services. According to the World Bank, approximately 1.4 billion adults worldwide lack access to traditional banking, predominantly residing in rural or underserved communities.

Microfinance emerges as a pivotal solution in addressing this financial exclusion. It not only provides microloans but also essential banking services such as savings and checking accounts. These offerings empower individuals to better manage financial emergencies and improve their economic resilience. Microfinance plays a critical role in global economic dynamics, fostering financial inclusion and social progress.

Microfinance initiatives contribute extensively to poverty alleviation by offering low-income individuals the financial resources needed for income-generating activities. By enabling aspiring entrepreneurs to start or expand small enterprises, microfinance stimulates economic growth and generates employment opportunities within communities. Particularly impactful is its role in advancing gender equality, empowering women through financial independence and enhancing their decision-making capabilities.

Moreover, microfinance bridges gaps in traditional banking systems, integrating marginalised populations into the formal financial sector. By enhancing access to financial services, microfinance supports advancements in education, healthcare, and overall living standards in underserved communities worldwide. This multifaceted impact underscores the profound significance of microfinance as a tool for inclusive economic development and social transformation.

Traditional Microfinance vs. Innovative Microfinance Solutions

| Traditional Microfinance | Innovative Microfinance Solutions |

| Loan Approval Process | |

|

Traditional microfinance involves a time-consuming and paperwork-intensive loan approval process. Clients often need to visit physical branches multiple times, submit numerous documents, and wait for manual verification. This can delay access to much-needed funds.

|

Innovative microfinance solutions streamline the loan approval process through digital platforms. Automated systems, powered by AI, handle verification and approval, significantly reducing the time from application to disbursement. This ensures faster access to funds and less hassle for clients.

|

| Credit Assessment | |

|

Traditional microfinance relies on conventional credit scores and collateral to assess creditworthiness. Many low-income individuals are excluded due to lack of formal credit history or collateral, limiting their access to financial services.

|

Innovative microfinance utilises alternative data sources and AI-based credit scoring. Factors such as mobile phone usage, social media activity, and transaction history are analysed to assess creditworthiness. This inclusive approach allows more individuals, including those without traditional credit histories, to access financial services.

|

| Reach and Scalability | |

|

Traditional microfinance is often limited to local regions with physical branches, restricting its reach and scalability. Expansion requires significant investment in infrastructure and human resources.

|

Innovative microfinance solutions leverage digital technology to reach a global audience. Mobile apps and online platforms enable scalability without the need for extensive physical infrastructure. This approach allows microfinance institutions to serve a larger and more diverse client base efficiently.

|

Comprehensive Microfinance Solutions: Features and Benefits

|

Feature

|

How It Works |

| Multi-Entity and Multi-Currency Support |

Supports operations across multiple entities and currencies, ensuring seamless financial transactions in diverse environments.

|

| Customer Registration | Facilitates efficient registration for centre, group, and individual customers, accommodating various client types. |

| Lead Origination and Portfolio Management |

Offers a workflow-based lead origination system with portfolio transfer and recovery management capabilities.

|

|

Collections Management

|

Provides integrated collection management compatible with OS and mobile devices, operable in both online and offline modes.

|

|

Regulatory & MIS Reporting

|

Ensures comprehensive regulatory compliance and Management Information System (MIS) reporting for accurate and timely insights.

|

|

eCO Onboarding Platform  |

Digital platform for completing field operations, streamlining the onboarding process and enhancing field efficiency. Â |

|

|

How It Helps? |

| Enhanced Processes |

Streamlined operations through advanced features and digital integration.

|

| Reduced TAT | Significantly reduced turnaround time, improving service delivery and customer satisfaction. |

| Real-Time Reporting |

Immediate access to real-time data and analytics, enhancing decision-making and operational oversight.

|

|

Enhanced Efficiency

|

Improved operational efficiency through automation and digital solutions.

|

|

Unified Solution

|

An all-in-one platform offering a comprehensive suite of tools for managing microfinance operations.

|

|

Improved Cash Management  |

Better cash management practices through integrated collection and reporting systems  |

Kaaveri, Saadhna, and Geeta, three women from a small village in Maharashtra, India, lived below the poverty line with no access to traditional banking services. Despite their aspirations to start a business selling homemade Indian spice mixes, they struggled to secure loans.

Microfinance: A Lifeline for Aspiring Entrepreneurs

A local Microfinance Institution (MFI) provided them with small loans, enabling them to purchase raw materials and packaging. The MFI’s group registration process, multi-entity support, and digital onboarding platform streamlined their access to financial resources and reduced turnaround time.

Empowerment Through Financial Literacy and Technology

The MFI also offered financial literacy training, equipping them with the knowledge to manage their business effectively. With OS and mobile device-based collections, they could manage transactions both online and offline, ensuring uninterrupted business operations.

As their business grew, they expanded their market beyond their village. The income generated improved their living standards, allowing them to provide better education and healthcare for their families.

Today, it is estimated that microfinance’s future is being shaped by emerging trends such as blockchain, AI-driven credit scoring, and sustainability. Blockchain technology ensures secure and transparent transactions, enhancing trust in financial processes. AI-powered credit scoring provides more accurate assessments, enabling fairer access to loans for underserved populations. Emphasising sustainability, microfinance institutions are increasingly supporting eco-friendly initiatives, ensuring long-term economic and environmental benefits. Together, these innovations are creating a more inclusive and efficient microfinance ecosystem.