Unlocking Financial Flexibility: Understanding Credit Line on UPI

India’s rapid ascent as a global leader in real-time digital payments owes much to the Unified Payments Interface (UPI), which now facilitates more than 40% of all such transactions. Â This technological advancement has not only fostered financial inclusion but also catalysed entrepreneurial opportunities within India’s burgeoning startup ecosystem. The recent proposal by the Reserve Bank of India (RBI) to expand UPI’s scope by integrating pre-approved credit lines marks a pivotal step towards enhancing digital payment adoption across the country.

This initiative aligns with RBI’s ambitious payments vision for 2025, which has the core theme of ‘E-Payments for Everyone, Everywhere, Every time’ (4Es). The vision aims to democratise access to formal credit while leveraging the seamless and secure infrastructure of UPI, providing every user with safe, secure, fast, convenient, accessible, and affordable e-payment options.

What is a Credit Line on UPI?

The Credit Line on UPI, known as ‘Pre-sanctioned Credit Line at Banks through UPI,’ represents an innovative financial service aimed at transforming the lending landscape. This facility enables individuals and businesses to access pre-approved credit lines directly through their respective bank accounts via UPI. By integrating this credit line into their UPI accounts, users streamline their financial management, eliminating the need for multiple credit cards and digitising the entire process. Transactions made through the UPI app linked to the credit line are reflected in the user’s loan account, providing a convenient and centralised method for managing expenses and repayments.

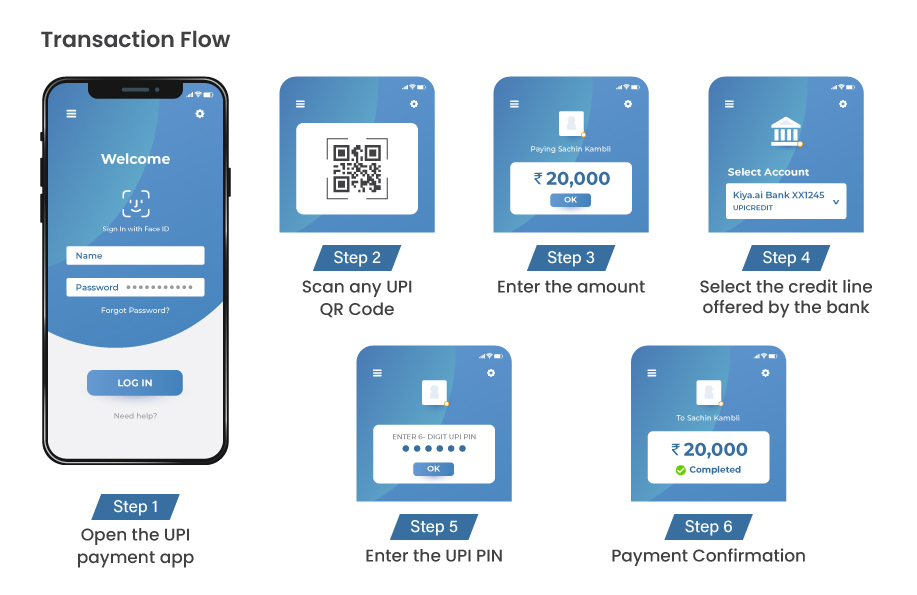

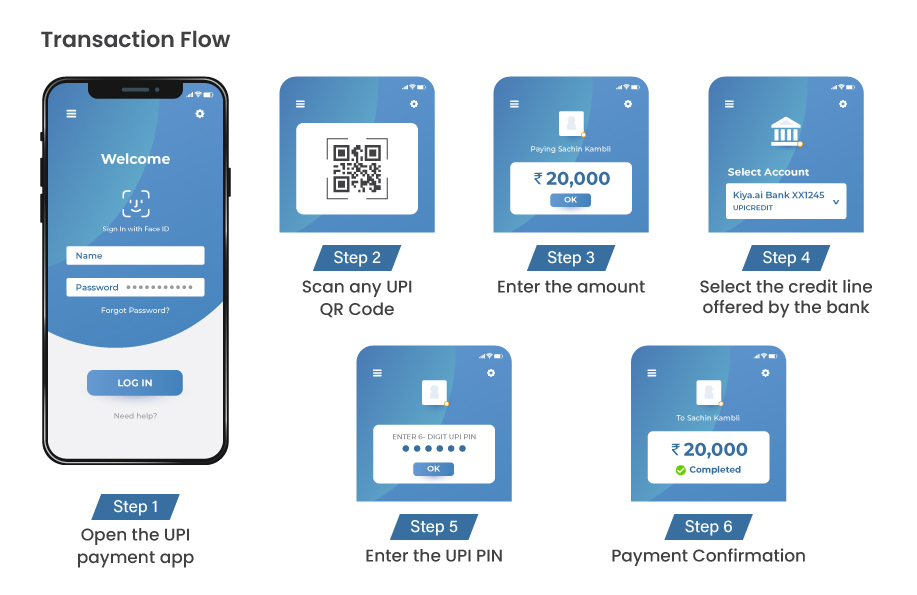

Steps to Access and Utilise Your Credit Line

The UPI (Unified Payments Interface) credit line offers users a convenient way to access funds on credit through their UPI-enabled bank accounts. Here’s a step-by-step guide on how it works:

- Credit Line Account Opening:

User will reach out the Bank & submit the necessary documents to get the Credit Line Account. Bank will do the required assessment and activate the Credit Line Account to proceed further.

- Utilisation of Credit:

Users can utilise the approved credit line as needed across multiple payment apps, thanks to UPI’s interoperable platform. This flexibility allows for easy access to credit for various transactions.

- Payment Process:

When using the credit facility, UPI apps will link to the user’s credit line, and debits will reflect in the loan account rather than the savings bank account. This ensures that credit usage is accurately tracked and managed.

- Repayment:

Repayment, along with applicable interest, can be settled at a later date, similar to credit card payments. This allows users to manage their finances effectively and repay the borrowed amount over time.

How UPI Credit Lines Enhance Financial Flexibility

- Instant Access to Funds:

Customers with UPI credit lines can enjoy immediate access to funds, eliminating the need to wait for traditional loan approvals. This instant availability empowers users to make purchases whenever needed, boosting sales for merchants, especially for high-value items like electronics and appliances.

- Seamless Transactions:

UPI credit lines simplify everyday transactions by allowing users to make purchases effortlessly, regardless of their current account balance. This feature ensures that businesses can maintain steady cash flow and continue operations without interruptions.

- Cost Efficiency:

UPI credit lines offer a cost-effective alternative to traditional credit products, often with lower interest rates. This affordability encourages more spending, benefiting both customers and merchants by reducing the financial burden associated with credit card usage.

- Enhanced Financial Management:

With flexible repayment options, UPI credit lines help users manage their finances more effectively. This flexibility fosters customer loyalty, as users appreciate the convenience and reliability of flexible payment terms. Additionally, merchants gain access to valuable transaction data, enabling them to tailor their offerings and marketing strategies to better meet customer preferences.

The Future of Credit Lines on UPI

The integration of credit lines into the Unified Payments Interface (UPI) represents a strategic evolution in financial services, enabling enhanced offerings for both customers and financial institutions. By incorporating credit lines within UPI, companies are facilitating convenient payment solutions, including fund transfers, credit repayments, and disbursements. This approach allows them to reach a broader customer base while offering competitive rates and reducing operational costs.

Looking forward, the future of credit lines on UPI holds promising developments. Anticipated trends include increased adoption rates as users recognise the convenience of managing credit through UPI. Future enhancements may include real-time credit approvals, personalised credit limits based on user behaviour, and integration with advanced financial management tools. Collaborations between banks, Non-Banking Financial Companies (NBFCs), and other financial institutions are expected to drive innovation and expand the range of financial products available on UPI.

These developments are set to create a more seamless and integrated financial ecosystem, empowering individuals and businesses to manage their finances efficiently in the digital age while promoting greater financial inclusion across India.

KiyaAI is at the forefront of digital payment solutions, offering comprehensive UPI services to banks and financial institutions. Our expertise in UPI integration ensures that banks can provide their customers with the latest in digital payment technology, including the revolutionary credit line feature. Get in touch with us today to discover our extensive UPI services and learn how we can transform your digital banking solutions.

India’s rapid ascent as a global leader in real-time digital payments owes much to the Unified Payments Interface (UPI), which now facilitates more than 40% of all such transactions. Â This technological advancement has not only fostered financial inclusion but also catalysed entrepreneurial opportunities within India’s burgeoning startup ecosystem. The recent proposal by the Reserve Bank of India (RBI) to expand UPI’s scope by integrating pre-approved credit lines marks a pivotal step towards enhancing digital payment adoption across the country.

This initiative aligns with RBI’s ambitious payments vision for 2025, which has the core theme of ‘E-Payments for Everyone, Everywhere, Every time’ (4Es). The vision aims to democratise access to formal credit while leveraging the seamless and secure infrastructure of UPI, providing every user with safe, secure, fast, convenient, accessible, and affordable e-payment options.

What is a Credit Line on UPI?

The Credit Line on UPI, known as ‘Pre-sanctioned Credit Line at Banks through UPI,’ represents an innovative financial service aimed at transforming the lending landscape. This facility enables individuals and businesses to access pre-approved credit lines directly through their respective bank accounts via UPI. By integrating this credit line into their UPI accounts, users streamline their financial management, eliminating the need for multiple credit cards and digitising the entire process. Transactions made through the UPI app linked to the credit line are reflected in the user’s loan account, providing a convenient and centralised method for managing expenses and repayments.

Steps to Access and Utilise Your Credit Line

The UPI (Unified Payments Interface) credit line offers users a convenient way to access funds on credit through their UPI-enabled bank accounts. Here’s a step-by-step guide on how it works:

- Credit Line Account Opening:

User will reach out the Bank & submit the necessary documents to get the Credit Line Account. Bank will do the required assessment and activate the Credit Line Account to proceed further.

- Utilisation of Credit:

Users can utilise the approved credit line as needed across multiple payment apps, thanks to UPI’s interoperable platform. This flexibility allows for easy access to credit for various transactions.

- Payment Process:

When using the credit facility, UPI apps will link to the user’s credit line, and debits will reflect in the loan account rather than the savings bank account. This ensures that credit usage is accurately tracked and managed.

- Repayment:

Repayment, along with applicable interest, can be settled at a later date, similar to credit card payments. This allows users to manage their finances effectively and repay the borrowed amount over time.

How UPI Credit Lines Enhance Financial Flexibility

- Instant Access to Funds:

Customers with UPI credit lines can enjoy immediate access to funds, eliminating the need to wait for traditional loan approvals. This instant availability empowers users to make purchases whenever needed, boosting sales for merchants, especially for high-value items like electronics and appliances.

- Seamless Transactions:

UPI credit lines simplify everyday transactions by allowing users to make purchases effortlessly, regardless of their current account balance. This feature ensures that businesses can maintain steady cash flow and continue operations without interruptions.

- Cost Efficiency:

UPI credit lines offer a cost-effective alternative to traditional credit products, often with lower interest rates. This affordability encourages more spending, benefiting both customers and merchants by reducing the financial burden associated with credit card usage.

- Enhanced Financial Management:

With flexible repayment options, UPI credit lines help users manage their finances more effectively. This flexibility fosters customer loyalty, as users appreciate the convenience and reliability of flexible payment terms. Additionally, merchants gain access to valuable transaction data, enabling them to tailor their offerings and marketing strategies to better meet customer preferences.

The Future of Credit Lines on UPI

The integration of credit lines into the Unified Payments Interface (UPI) represents a strategic evolution in financial services, enabling enhanced offerings for both customers and financial institutions. By incorporating credit lines within UPI, companies are facilitating convenient payment solutions, including fund transfers, credit repayments, and disbursements. This approach allows them to reach a broader customer base while offering competitive rates and reducing operational costs.

Looking forward, the future of credit lines on UPI holds promising developments. Anticipated trends include increased adoption rates as users recognise the convenience of managing credit through UPI. Future enhancements may include real-time credit approvals, personalised credit limits based on user behaviour, and integration with advanced financial management tools. Collaborations between banks, Non-Banking Financial Companies (NBFCs), and other financial institutions are expected to drive innovation and expand the range of financial products available on UPI.

These developments are set to create a more seamless and integrated financial ecosystem, empowering individuals and businesses to manage their finances efficiently in the digital age while promoting greater financial inclusion across India.

KiyaAI is at the forefront of digital payment solutions, offering comprehensive UPI services to banks and financial institutions. Our expertise in UPI integration ensures that banks can provide their customers with the latest in digital payment technology, including the revolutionary credit line feature. Get in touch with us today to discover our extensive UPI services and learn how we can transform your digital banking solutions.