Future-Proof Onboarding Processes with DigiLocker Integration

In today’s fast-paced digital world, 74% of potential customers abandon the onboarding process due to complex and time-consuming procedures. Additionally, only 40% of companies report a positive onboarding experience, highlighting a critical need for improvement.  Introducing DigiLocker, a revolutionary tool transforming customer onboarding in banking.

DigiLocker, part of the Government of India’s Digital India initiative, provides a secure, cloud-based platform for storing and sharing documents electronically. This minimises the reliance on physical documents and streamlines the verification process. By integrating DigiLocker, banks can significantly enhance the customer onboarding experience.

As the banking industry undergoes major digital transformations to meet the demands of a digitally focused world, tools like DigiLocker become essential. This platform offers Indian citizens a shareable private space on a public cloud, linked to their Aadhaar number, where organisations can directly push electronic documents. Users can also upload and electronically sign scanned copies of their legacy documents.

Integrating DigiLocker into the onboarding process offers banks a seamless, efficient, and secure way to handle document verification, reducing customer effort and improving satisfaction. This not only decreases dropout rates but also enhances overall operational efficiency.

What is DigiLocker?

DigiLocker is a flagship initiative of MeitY under Digital India programme. It aims at ‘Digital Empowerment’ of citizen by providing access to authentic digital documents to citizen’s digital document wallet. DigiLocker is a secure cloud-based platform for storage, sharing and verification of documents & certificates.

Traditional Customer Onboarding vs. DigiLocker Integration

| Traditional Customer Onboarding | DigiLocker Integration

|

| Time Consumption | |

| Lengthy paperwork and manual verification processes | Digital submission of documents, reducing paperwork |

| Customer Experience | |

| Lower satisfaction and retention due to delays and complexity | Improved experience with faster and more efficient onboarding

|

| Compliance and Security | |

| Challenges in meeting compliance requirements and ensuring data security

|

Enhanced security features protecting sensitive information, aiding compliance |

| Documentation | |

| Multiple physical documents required

|

Customers can digitally submit all necessary documents |

| Verification | |

| Manual verification leads to longer onboarding times

|

Instant document verification, significantly reducing onboarding time

|

| Security | |

| Risk of data breaches and document loss

|

256-bit SSL encryption and secure storage ensure document safety |

| Compliance | |

| Complex and time-consuming compliance processes | Easy compliance with regulatory requirements through digital solutions |

- Document Security:

Worrying about the safety of your important documents is a thing of the past. DigiLocker ensures the complete security of your documents and allows access whenever needed. With 256-bit SSL certificates, all information provided for document issuance is encrypted, safeguarding your personal data.

- Secure Digital Signing:

The E-Signature feature, also known as self-attestation, provides a secure way to sign electronic documents digitally. Your Aadhaar number is linked to your digital signatures, making it a one-time process. Unlike private digital signatures that require an annual fee, DigiLocker signatures are free.

- Promoting Paperless Documentation:

DigiLocker supports the government’s initiative to promote paperless documentation, helping to save paper for the future. After registration, you can safely upload scanned documents such as graduation certificates, PAN cards, Aadhaar cards, driving licences, passports, electricity bills, and other necessary documents.

- Easy Document Verification:

When government agencies require legal documents for verification, simply provide your locker number. Agencies can quickly verify your identity without needing original documents, reducing the risk of misplacement.

- Fraud Prevention:

Digitisation reduces the risk of fraud, allowing safer document sharing. Ensure you don’t share your DigiLocker number or Aadhaar details with anyone and avoid using public Wi-Fi or hotspots to access DigiLocker.

- Ample Storage Space:

DigiLocker offers an initial 10MB of free storage space for essential documents. The government plans to expand this space to 1GB per locker, allowing you to store even more documents.

- Cost Efficiency:

Digitisation reduces government operational costs, including staffing and related expenses, thereby controlling expenditures and contributing to economic growth.

- Faster Processing:

With streamlined digital processes, applications for PAN cards or other documents become quicker. The ability to e-sign through DigiLocker and Aadhaar KYC services speeds up the entire process.

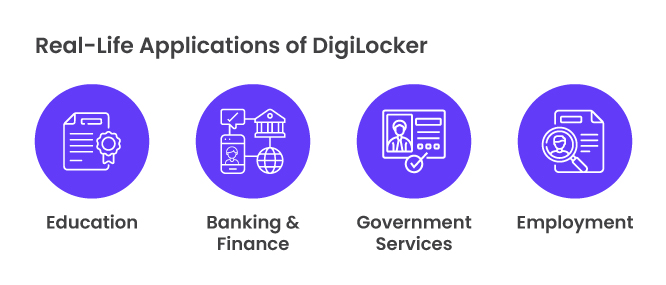

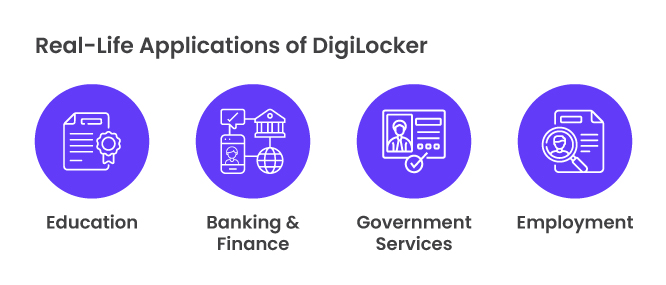

- Education:

Store and share your educational certificates.

- Banking & Finance:

Simplifies KYC processes by providing digital access to required documents.

- Government Services:

Access documents like Aadhaar, PAN, and driving license.

- Employment:

Share your verified documents with employers.

Steps to Integrate DigiLocker with Your Bank

Assessment of Current Onboarding Process

Integrating DigiLocker with your bank begins with a thorough assessment of your current onboarding process. This initial step involves analysing how documents are currently collected, verified, and stored, while also evaluating areas where inefficiencies, such as lengthy processing times or manual errors, may be impacting customer satisfaction. Ensuring compliance with regulatory standards, especially regarding data security and document retention policies, is also crucial during this assessment phase. By conducting a robust evaluation, banks can identify opportunities where DigiLocker can streamline operations, enhance compliance, and ultimately improve the overall customer experience.

Development of Comprehensive Integration Plan

Developing a comprehensive integration plan is essential to effectively incorporate DigiLocker into existing banking systems. This plan includes collaborating closely with IT teams to integrate DigiLocker APIs seamlessly. It is important to ensure compatibility with current systems, implement robust data security protocols, and establish efficient workflows for document submission, verification, and retrieval through DigiLocker. Constant testing and validation of integration functionalities are also critical to find out any technical issues and ensure a smooth transition. A well-executed integration plan not only enhances document management capabilities but also upholds operational integrity and regulatory compliance standards.

Implementation of Training and Support Programmes

Investing in training and ongoing support is necessary for the successful integration of DigiLocker. Empowering staff with the necessary knowledge enables them to guide customers seamlessly through the new onboarding process and address enquiries related to DigiLocker integration. This proactive approach not only modernises document management but also strengthens data security measures, reduces operational costs, and improves overall efficiency, positioning banks to meet the growing digital expectations of customers while complying with stringent regulatory requirements.

Looking ahead, the future of DigiLocker appears promising as it expands its role within India’s ever-growing fintech landscape. With the fintech market projected to grow significantly, reaching USD 608.35 billion by 2029Â , DigiLocker’s evolution into a comprehensive repository for individual documents is here to play an important role.

By integrating with Aadhaar and leveraging India’s robust digital infrastructure, DigiLocker aims to streamline document management across government agencies and regulated entities, fostering a seamless ecosystem for identity verification. In addition to this, DigiLocker provides an API to “get e-Aadhaar Data in XML Format.” This feature allows organisations to access verified Aadhaar data, which can be used to add or update customer addresses in onboarding databases efficiently. By incorporating this API, businesses can ensure that their customer information is accurate and up-to-date, further enhancing the onboarding experience.

KiyaAI stands at the forefront as a technology provider facilitating seamless DigiLocker integration services. With a proven track record in digital banking solutions and successful integrations, KiyaAI brings expertise and experience to enhance the adoption and implementation of DigiLocker across banking institutions. For more information on how DigiLocker integration can benefit your bank or to explore collaboration opportunities, feel free to reach out to KiyaAI today.

In today’s fast-paced digital world, 74% of potential customers abandon the onboarding process due to complex and time-consuming procedures. Additionally, only 40% of companies report a positive onboarding experience, highlighting a critical need for improvement.  Introducing DigiLocker, a revolutionary tool transforming customer onboarding in banking.

DigiLocker, part of the Government of India’s Digital India initiative, provides a secure, cloud-based platform for storing and sharing documents electronically. This minimises the reliance on physical documents and streamlines the verification process. By integrating DigiLocker, banks can significantly enhance the customer onboarding experience.

As the banking industry undergoes major digital transformations to meet the demands of a digitally focused world, tools like DigiLocker become essential. This platform offers Indian citizens a shareable private space on a public cloud, linked to their Aadhaar number, where organisations can directly push electronic documents. Users can also upload and electronically sign scanned copies of their legacy documents.

Integrating DigiLocker into the onboarding process offers banks a seamless, efficient, and secure way to handle document verification, reducing customer effort and improving satisfaction. This not only decreases dropout rates but also enhances overall operational efficiency.

What is DigiLocker?

DigiLocker is a flagship initiative of MeitY under Digital India programme. It aims at ‘Digital Empowerment’ of citizen by providing access to authentic digital documents to citizen’s digital document wallet. DigiLocker is a secure cloud-based platform for storage, sharing and verification of documents & certificates.

Traditional Customer Onboarding vs. DigiLocker Integration

| Traditional Customer Onboarding | DigiLocker Integration

|

| Time Consumption | |

| Lengthy paperwork and manual verification processes | Digital submission of documents, reducing paperwork |

| Customer Experience | |

| Lower satisfaction and retention due to delays and complexity | Improved experience with faster and more efficient onboarding

|

| Compliance and Security | |

| Challenges in meeting compliance requirements and ensuring data security

|

Enhanced security features protecting sensitive information, aiding compliance |

| Documentation | |

| Multiple physical documents required

|

Customers can digitally submit all necessary documents |

| Verification | |

| Manual verification leads to longer onboarding times

|

Instant document verification, significantly reducing onboarding time

|

| Security | |

| Risk of data breaches and document loss

|

256-bit SSL encryption and secure storage ensure document safety |

| Compliance | |

| Complex and time-consuming compliance processes | Easy compliance with regulatory requirements through digital solutions |

- Document Security:

Worrying about the safety of your important documents is a thing of the past. DigiLocker ensures the complete security of your documents and allows access whenever needed. With 256-bit SSL certificates, all information provided for document issuance is encrypted, safeguarding your personal data.

- Secure Digital Signing:

The E-Signature feature, also known as self-attestation, provides a secure way to sign electronic documents digitally. Your Aadhaar number is linked to your digital signatures, making it a one-time process. Unlike private digital signatures that require an annual fee, DigiLocker signatures are free.

- Promoting Paperless Documentation:

DigiLocker supports the government’s initiative to promote paperless documentation, helping to save paper for the future. After registration, you can safely upload scanned documents such as graduation certificates, PAN cards, Aadhaar cards, driving licences, passports, electricity bills, and other necessary documents.

- Easy Document Verification:

When government agencies require legal documents for verification, simply provide your locker number. Agencies can quickly verify your identity without needing original documents, reducing the risk of misplacement.

- Fraud Prevention:

Digitisation reduces the risk of fraud, allowing safer document sharing. Ensure you don’t share your DigiLocker number or Aadhaar details with anyone and avoid using public Wi-Fi or hotspots to access DigiLocker.

- Ample Storage Space:

DigiLocker offers an initial 10MB of free storage space for essential documents. The government plans to expand this space to 1GB per locker, allowing you to store even more documents.

- Cost Efficiency:

Digitisation reduces government operational costs, including staffing and related expenses, thereby controlling expenditures and contributing to economic growth.

- Faster Processing:

With streamlined digital processes, applications for PAN cards or other documents become quicker. The ability to e-sign through DigiLocker and Aadhaar KYC services speeds up the entire process.

- Education:

Store and share your educational certificates.

- Banking & Finance:

Simplifies KYC processes by providing digital access to required documents.

- Government Services:

Access documents like Aadhaar, PAN, and driving license.

- Employment:

Share your verified documents with employers.

Steps to Integrate DigiLocker with Your Bank

Assessment of Current Onboarding Process

Integrating DigiLocker with your bank begins with a thorough assessment of your current onboarding process. This initial step involves analysing how documents are currently collected, verified, and stored, while also evaluating areas where inefficiencies, such as lengthy processing times or manual errors, may be impacting customer satisfaction. Ensuring compliance with regulatory standards, especially regarding data security and document retention policies, is also crucial during this assessment phase. By conducting a robust evaluation, banks can identify opportunities where DigiLocker can streamline operations, enhance compliance, and ultimately improve the overall customer experience.

Development of Comprehensive Integration Plan

Developing a comprehensive integration plan is essential to effectively incorporate DigiLocker into existing banking systems. This plan includes collaborating closely with IT teams to integrate DigiLocker APIs seamlessly. It is important to ensure compatibility with current systems, implement robust data security protocols, and establish efficient workflows for document submission, verification, and retrieval through DigiLocker. Constant testing and validation of integration functionalities are also critical to find out any technical issues and ensure a smooth transition. A well-executed integration plan not only enhances document management capabilities but also upholds operational integrity and regulatory compliance standards.

Implementation of Training and Support Programmes

Investing in training and ongoing support is necessary for the successful integration of DigiLocker. Empowering staff with the necessary knowledge enables them to guide customers seamlessly through the new onboarding process and address enquiries related to DigiLocker integration. This proactive approach not only modernises document management but also strengthens data security measures, reduces operational costs, and improves overall efficiency, positioning banks to meet the growing digital expectations of customers while complying with stringent regulatory requirements.

Looking ahead, the future of DigiLocker appears promising as it expands its role within India’s ever-growing fintech landscape. With the fintech market projected to grow significantly, reaching USD 608.35 billion by 2029Â , DigiLocker’s evolution into a comprehensive repository for individual documents is here to play an important role.

By integrating with Aadhaar and leveraging India’s robust digital infrastructure, DigiLocker aims to streamline document management across government agencies and regulated entities, fostering a seamless ecosystem for identity verification. In addition to this, DigiLocker provides an API to “get e-Aadhaar Data in XML Format.” This feature allows organisations to access verified Aadhaar data, which can be used to add or update customer addresses in onboarding databases efficiently. By incorporating this API, businesses can ensure that their customer information is accurate and up-to-date, further enhancing the onboarding experience.

KiyaAI stands at the forefront as a technology provider facilitating seamless DigiLocker integration services. With a proven track record in digital banking solutions and successful integrations, KiyaAI brings expertise and experience to enhance the adoption and implementation of DigiLocker across banking institutions. For more information on how DigiLocker integration can benefit your bank or to explore collaboration opportunities, feel free to reach out to KiyaAI today.