Digital Lending Solution: A Contemporary Approach to Access & Manage the Entire Lending Life Cycle

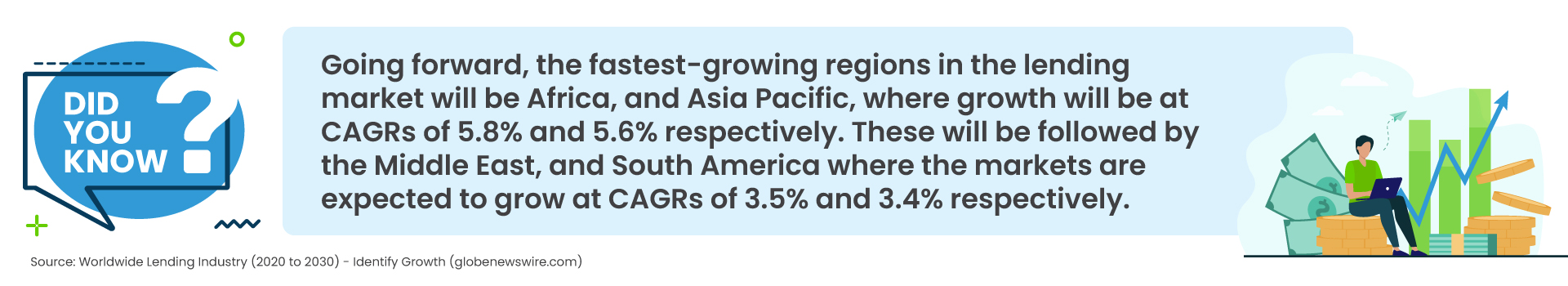

The global fintech sector’s exponential growth has indeed been influenced by a convergence of factors, including regulatory changes, significant venture capital investment, and rapid technological advancements. Two pivotal elements shaping this development are the expanding significance of digital banking and the opportunities it creates for market expansion.

In this rapidly evolving landscape, it’s essential to delve deeper into the dichotomy between traditional banking systems and their digitally driven counterparts to understand how they shape the future of financial services.

Traditional System Vs Digital Solutions

Traditional banking clings to legacy processes, while digital solutions embrace innovation, efficiency, and global accessibility.

Traditional lending systems often relied on cumbersome processes that required in-person interactions at every stage, which resulted in longer processing times and increased the likelihood of human error. Along with this, conventional lending methods are known for their prolonged processes in verifying the legitimacy of hard-copy documents or acquiring clearance from multiple authorities. The more personal information and data saved on paper, the greater the risk of information loss. Aside from the security concern, the difficulty in accessing or restoring information in hard-copy form was also a disadvantage.

However, owing to Digital Lending, that cumbersome process is no longer required, and the entire lending cycle can be concluded in the blink of an eye.

Thanks to agile digital core banking solutions, nowadays, lenders can promptly integrate customers’ data, including information about prior loans, current outstanding obligations, and credit scores, among other factors, this enables lenders to make decisions faster and provide exclusive lending options in accordance with customer requirements. As a result, several financial service companies are collaborating with fintech providers to enhance their lending process.

How KiyaAI’s Digital Lending Solution is a Superior Alternative to Credit Score-Based Traditional Methods

Conventional credit scoring systems have long leaned on credit history as their cornerstone, but this leaves a significant gap for the unbanked or underbanked, individuals who often lack the traditional financial records that these systems require.

What truly distinguishes KiyaAI is its capacity to harness the full potential of Artificial Intelligence (AI), fundamentally reshaping how financial institutions approach the critical process of lending decisions. Through a meticulous and comprehensive analysis of an individual’s non-traditional data sources, such as social media activity, utility payments, GST payments and rental history,KiyaAI’s Digital Lending Solution creates comprehensive credit profiles. This allows financial institutions to make more informed lending decisions and expand access to credit for individuals who may not have been eligible under traditional methods .

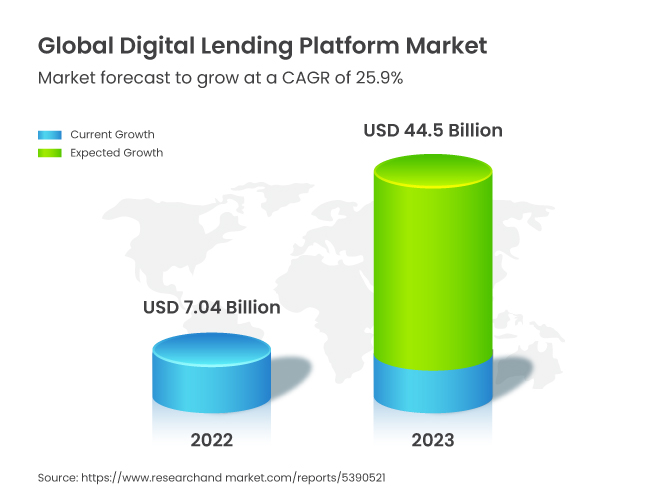

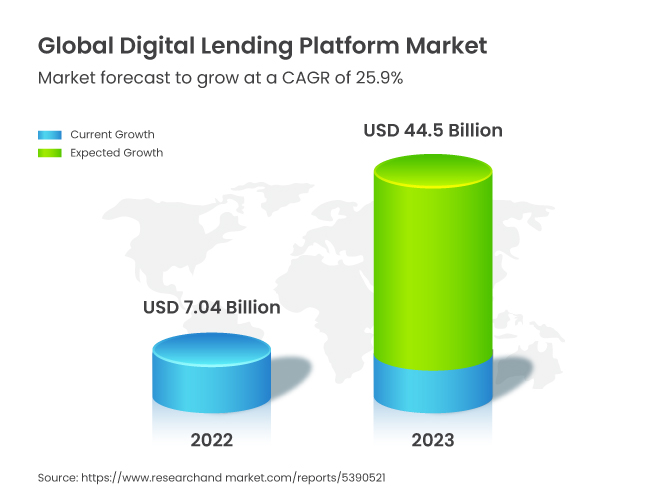

Digital lending: A key segment of the global fintech sector

Digital lending has been described by financial institutions and banks as a remote and automated lending process that primarily relies on seamless technological innovations for customer acquisition, disbursement, recovery, and additional customer support. As the race for profitable loan customers heats up, financial institutions must establish a digital lending ecosystem- a corresponding set of services that address a wider range of borrowers’ financial needs. By doing this, financial institutions can improve their market position in a sector that is undergoing rapid evolution and elevate retention and value over the long term.Â

These days, Millennials and Gen Z are also increasingly accepting the idea of micro-credit and purchasing ‘buy-now- pay- later (BNPL)’ services. Digital lending platforms cater to a diverse clientele, ranging from individual retail customers to micro, small and medium-sized enterprises (MSMEs). They offer a variety of financial services, such as small personal loans for buying a new fridge, buy-now, pay-later loans for education, vehicles, or even small mortgages. Customers are provided with convenient mobile credit access through the service. In comparison to a bank branch office, it also guarantees less paperwork and fewer eligibility checks.

Here is how an ideal digital lending solution supports dynamic business environments

It is undeniable that each financial institution has distinct criteria for operations. Banks today prefer a best practice approach that is adaptable and can accommodate the dynamic nature of business and process execution. Listed below are a few significant factors that each bank should consider while identifying the right digital lending solution provider:

Loan Origination System (LOS) to regulate lending cycle

Offering loans should be straightforward, but conventional lending structures frequently make things complex! Given that consumers prefer to transact online, it is crucial for lenders to have a digital loan origination system in order to remain competitive. A Loan Origination System is developed to regulate the complete lending cycle, from application to distribution. Once a borrower requests a loan, banks should be able assist customer onboarding by utilizing a robust loan origination system. The loan application process benefits from the integration of a loan origination system in several ways, including credit history verification, loan pricing, digital KYC, and disbursal.

Interested in learning more about this Success Story? Download Now

High Scalability

‘Lower risk, higher income’ is the ultimate goal of every financial firm. However, identifying risk manually for each individual can be a complex and time-consuming task. The loan eligibility and possible risk exposure are determined on parameters including the customer’s monthly cash flow, collateral value, transaction history, income tax history, behavioral patterns, and predicted inflation.

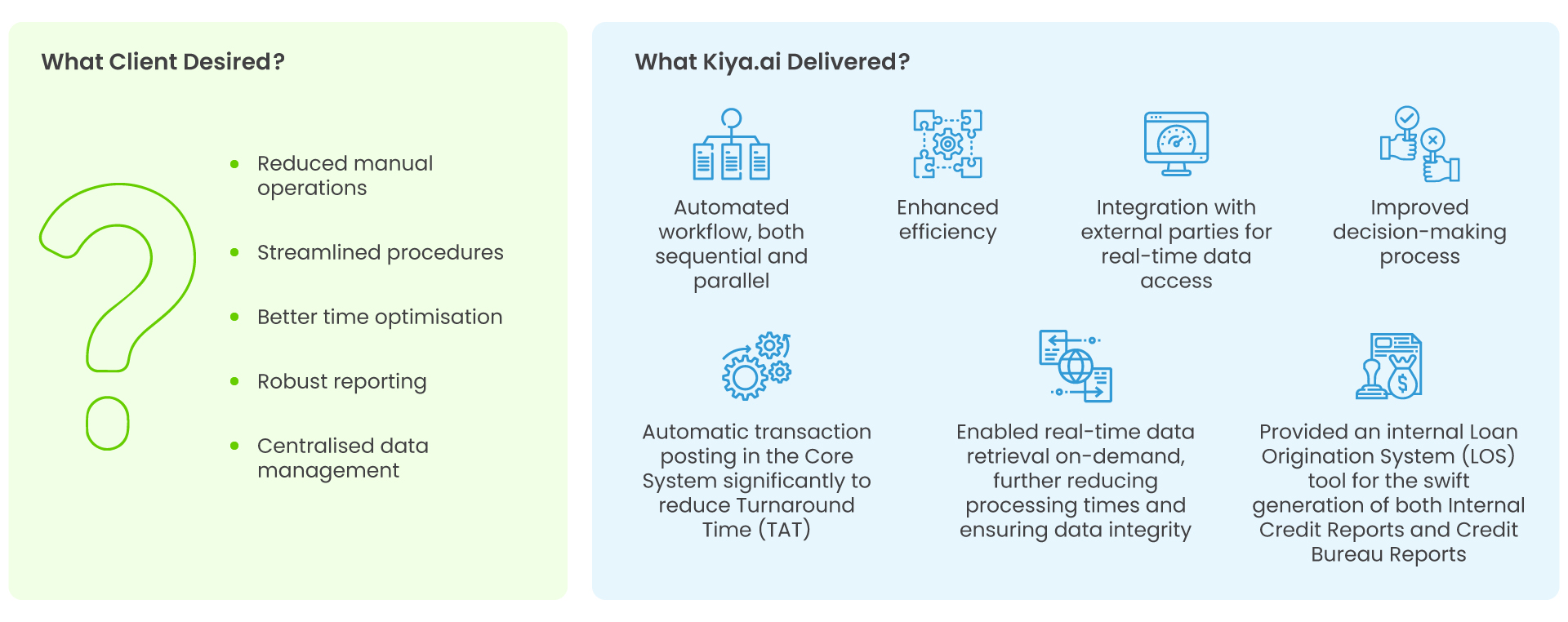

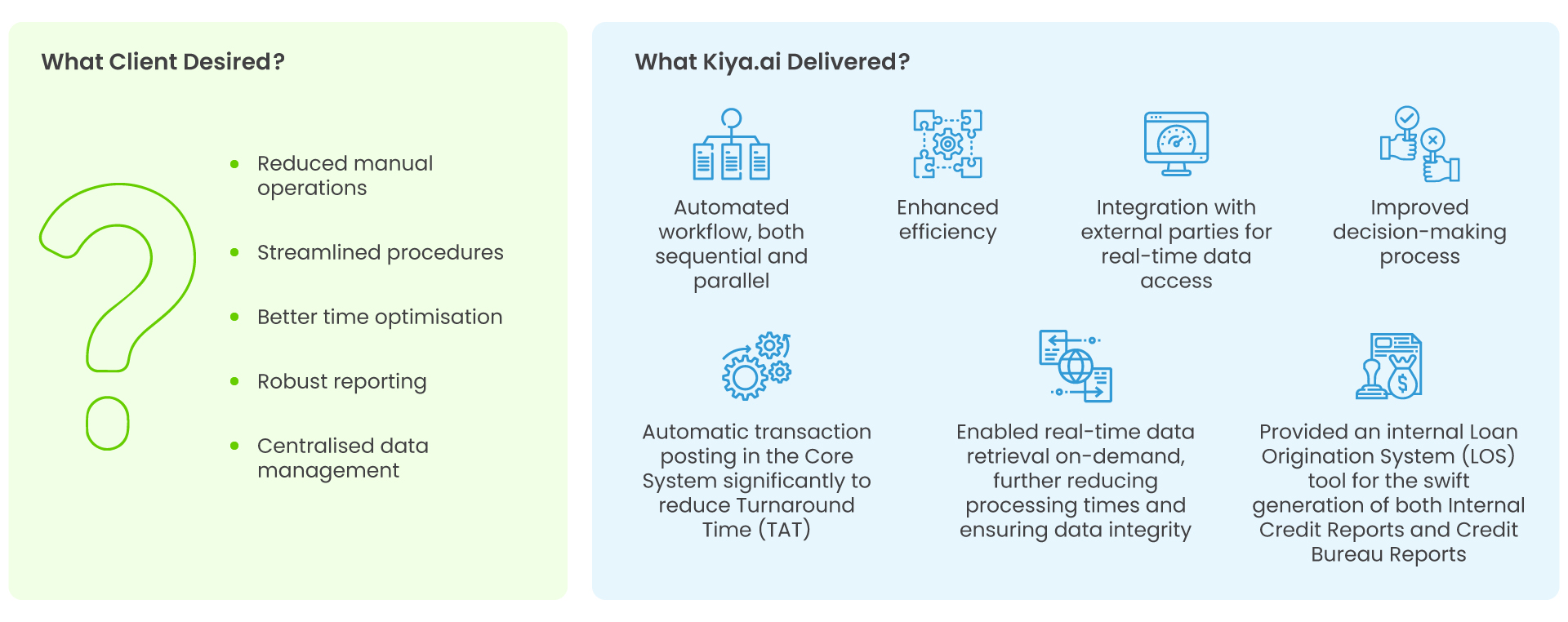

In addition to all of these, the application process can be challenging for those applying for the first time without a credit score. The Digital Lending Solution expedites and improves the decision-making process by integrating with external applications and systems, monitoring prospects’ online activity, and using it to assess their financial health.

Ensure accurate decision making with actionable insights:

Making quick and well-informed credit judgements can be made easier with the support of the right lending solution, which can assist in the analysis of enormous data sets and provide crucial insights into a potential or existing client. With the support of the raw data, the solution can assist in identifying patterns and insights that are relevant and helpful as well as track client behavior based on browsing history and online footprints. Creditors can then evaluate an applicant’s creditworthiness using the data points and credit scores.

It is fairly safe to conclude that consumers want their loan requests to be responded to more quickly, and banks want the right technology partner who can help them with the most effective cutting-edge technology to do so. KiyaAI’s robust Digital Lending Solutions can eliminate operational barriers, consolidate your front and back offices, and expedite your lending process.

The global fintech sector’s exponential growth has indeed been influenced by a convergence of factors, including regulatory changes, significant venture capital investment, and rapid technological advancements. Two pivotal elements shaping this development are the expanding significance of digital banking and the opportunities it creates for market expansion.

In this rapidly evolving landscape, it’s essential to delve deeper into the dichotomy between traditional banking systems and their digitally driven counterparts to understand how they shape the future of financial services.

Traditional System Vs Digital Solutions

Traditional banking clings to legacy processes, while digital solutions embrace innovation, efficiency, and global accessibility.

Traditional lending systems often relied on cumbersome processes that required in-person interactions at every stage, which resulted in longer processing times and increased the likelihood of human error. Along with this, conventional lending methods are known for their prolonged processes in verifying the legitimacy of hard-copy documents or acquiring clearance from multiple authorities. The more personal information and data saved on paper, the greater the risk of information loss. Aside from the security concern, the difficulty in accessing or restoring information in hard-copy form was also a disadvantage.

However, owing to Digital Lending, that cumbersome process is no longer required, and the entire lending cycle can be concluded in the blink of an eye.

Thanks to agile digital core banking solutions, nowadays, lenders can promptly integrate customers’ data, including information about prior loans, current outstanding obligations, and credit scores, among other factors, this enables lenders to make decisions faster and provide exclusive lending options in accordance with customer requirements. As a result, several financial service companies are collaborating with fintech providers to enhance their lending process.

How KiyaAI’s Digital Lending Solution is a Superior Alternative to Credit Score-Based Traditional Methods

Conventional credit scoring systems have long leaned on credit history as their cornerstone, but this leaves a significant gap for the unbanked or underbanked, individuals who often lack the traditional financial records that these systems require.

What truly distinguishes KiyaAI is its capacity to harness the full potential of Artificial Intelligence (AI), fundamentally reshaping how financial institutions approach the critical process of lending decisions. Through a meticulous and comprehensive analysis of an individual’s non-traditional data sources, such as social media activity, utility payments, GST payments and rental history, KiyaAI’s Digital Lending Solution creates comprehensive credit profiles. This allows financial institutions to make more informed lending decisions and expand access to credit for individuals who may not have been eligible under traditional methods .

Digital lending: A key segment of the global fintech sector

Digital lending has been described by financial institutions and banks as a remote and automated lending process that primarily relies on seamless technological innovations for customer acquisition, disbursement, recovery, and additional customer support. As the race for profitable loan customers heats up, financial institutions must establish a digital lending ecosystem- a corresponding set of services that address a wider range of borrowers’ financial needs. By doing this, financial institutions can improve their market position in a sector that is undergoing rapid evolution and elevate retention and value over the long term.Â

These days, Millennials and Gen Z are also increasingly accepting the idea of micro-credit and purchasing ‘buy-now- pay- later (BNPL)’ services. Digital lending platforms cater to a diverse clientele, ranging from individual retail customers to micro, small and medium-sized enterprises (MSMEs). They offer a variety of financial services, such as small personal loans for buying a new fridge, buy-now, pay-later loans for education, vehicles, or even small mortgages. Customers are provided with convenient mobile credit access through the service. In comparison to a bank branch office, it also guarantees less paperwork and fewer eligibility checks.

Here is how an ideal digital lending solution supports dynamic business environments

It is undeniable that each financial institution has distinct criteria for operations. Banks today prefer a best practice approach that is adaptable and can accommodate the dynamic nature of business and process execution. Listed below are a few significant factors that each bank should consider while identifying the right digital lending solution provider:

Loan Origination System (LOS) to regulate lending cycle

Offering loans should be straightforward, but conventional lending structures frequently make things complex! Given that consumers prefer to transact online, it is crucial for lenders to have a digital loan origination system in order to remain competitive. A Loan Origination System is developed to regulate the complete lending cycle, from application to distribution. Once a borrower requests a loan, banks should be able assist customer onboarding by utilizing a robust loan origination system. The loan application process benefits from the integration of a loan origination system in several ways, including credit history verification, loan pricing, digital KYC, and disbursal.

Interested in learning more about this Success Story? Download Now

High Scalability

‘Lower risk, higher income’ is the ultimate goal of every financial firm. However, identifying risk manually for each individual can be a complex and time-consuming task. The loan eligibility and possible risk exposure are determined on parameters including the customer’s monthly cash flow, collateral value, transaction history, income tax history, behavioral patterns, and predicted inflation.

In addition to all of these, the application process can be challenging for those applying for the first time without a credit score. The Digital Lending Solution expedites and improves the decision-making process by integrating with external applications and systems, monitoring prospects’ online activity, and using it to assess their financial health.

Ensure accurate decision making with actionable insights:

Making quick and well-informed credit judgements can be made easier with the support of the right lending solution, which can assist in the analysis of enormous data sets and provide crucial insights into a potential or existing client. With the support of the raw data, the solution can assist in identifying patterns and insights that are relevant and helpful as well as track client behavior based on browsing history and online footprints. Creditors can then evaluate an applicant’s creditworthiness using the data points and credit scores.

It is fairly safe to conclude that consumers want their loan requests to be responded to more quickly, and banks want the right technology partner who can help them with the most effective cutting-edge technology to do so. KiyaAI’s robust Digital Lending Solutions can eliminate operational barriers, consolidate your front and back offices, and expedite your lending process.