Overview

Want to elevate your customer experiences, drive operational efficiencies, and manage constantly changing local and global regulatory requirements with increases agility?

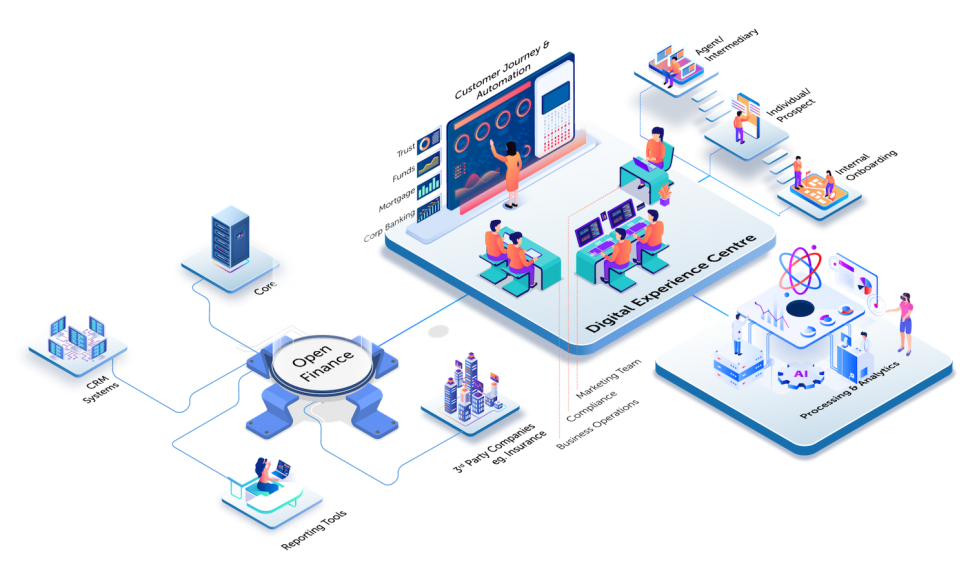

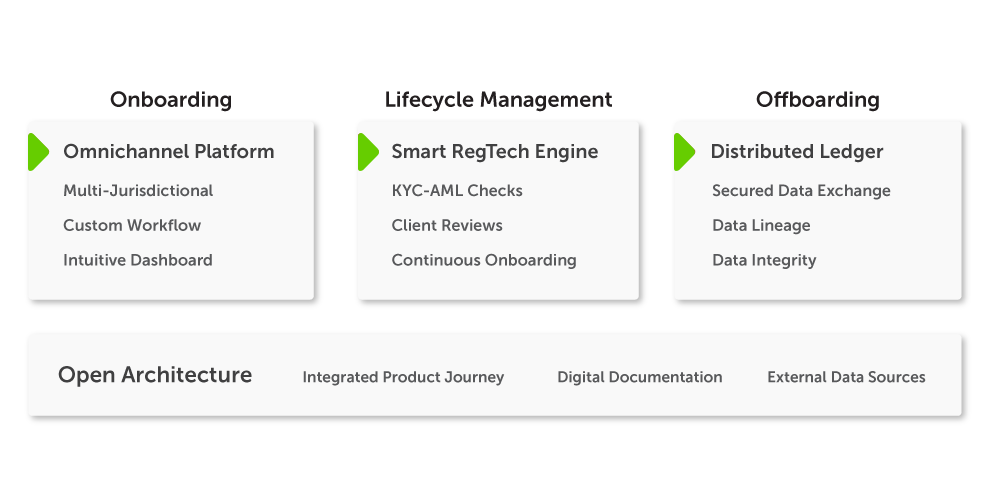

eCO empowers to seamlessly orchestrate all your global office processes for complex multi-product and multi-jurisdictional customer onboarding and customer lifecycle management. It enables to automate all the Know Your Customer (KYC) obligations ensuring regulatory compliance and providing a single view of customer data throughout the Customer Lifecycle from onboarding to off-boarding. eCO Digital Onboarding Solution will you cater to the ever-changing & growing demands of today customers while driving competitive advantages.

Components of Client Journey

Key Capabilities

Advantages with eCO Digital Customer Onboarding Solution

Updates

-

Digital Banking Units: A Catalyst for Innovation in Financial Services

Discover how Digital Banking Units (DBUs) are helping the banking sector with advanced technology, enhanced customer services, and increased financial inclusion. Learn how DBUs are shaping the future of banking.

-

UPI Circle: Empowering Delegated Payments for Seamless Financial Management

Discover how UPI Circle is revolutionising delegated payments, allowing users to securely share their UPI account access for greater flexibility and control in digital transactions.