The Cost of Non-Compliance: Why Effective KYC is Crucial

In the increasingly interconnected global financial system, the importance of robust Know Your Customer (KYC) processes cannot be overstated. Effective KYC not only helps institutions combat illegal activities but also safeguards them from significant financial and reputational risks. Non-compliance can result in severe penalties, making it crucial for financial entities to prioritise KYC.

The Growing Importance of KYC

KYC policies are fundamental to the global fight against financial crime, encompassing money laundering, terrorism financing, and other illicit activities. Governments and central banks worldwide are expanding the scope of KYC regulations to cover nearly every part of the global financial ecosystem. This heightened focus on KYC stems from the rising prevalence of financial crime and the increasing number of connections between financial organisations and corporate entities across countries and territories. As more value moves globally each day, the challenge of preventing illegal financial activities grows, prompting regulators to adapt and strengthen KYC checks continuously.

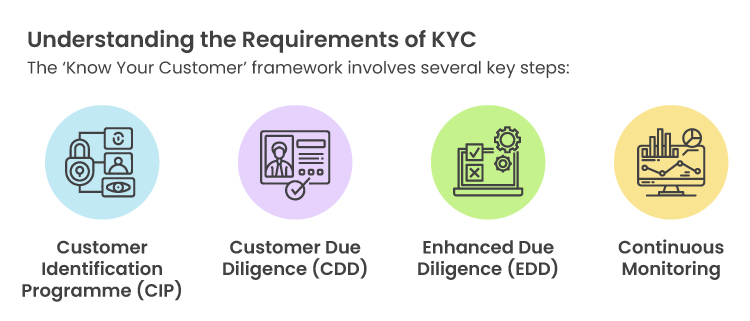

- Customer Identification Programme (CIP):

Financial institutions must obtain essential identifying information from customers, including name, date of birth, address, and identification number. Many organisations also screen customers against government sanctions lists, politically exposed person (PEP) lists, and known terrorism lists. This helps identify individuals requiring enhanced due diligence.

- Customer Due Diligence (CDD):

This process involves sorting and analysing the information gathered during CIP. Financial institutions assess the nature and purpose of customer relationships to ensure they align with known customer profiles. The goal is to confirm customer identity and assess risk, monitoring for unusual activity or changes that may indicate financial crime.

- Enhanced Due Diligence (EDD):

For higher-risk customers, financial institutions conduct more detailed investigations, including source of wealth verification and third-party research. High-risk customers may have political ties, connections to designated individuals, or reside in high-risk countries.

- Continuous Monitoring:

Continuous monitoring is essential as a customer’s situation can change rapidly. Financial institutions must rescreen customers through AML and KYC processes to ensure ongoing eligibility.

The Implications of Non-Compliance

All financial institutions must comply with specific anti-money laundering (AML) regulations, particularly those related to KYC. Originally, these regulations applied primarily to traditional financial institutions such as banks, credit unions, and insurance firms. However, the definition of ‘financial institution’ has broadened over time to include fintech companies, cryptocurrency exchanges, and other non-traditional financial entities.

Failure to comply with KYC regulations can result in severe consequences, including multimillion-dollar fines and criminal prosecution. Non-compliance not only poses financial risks but also damages an institution’s reputation, undermining customer trust and market credibility.

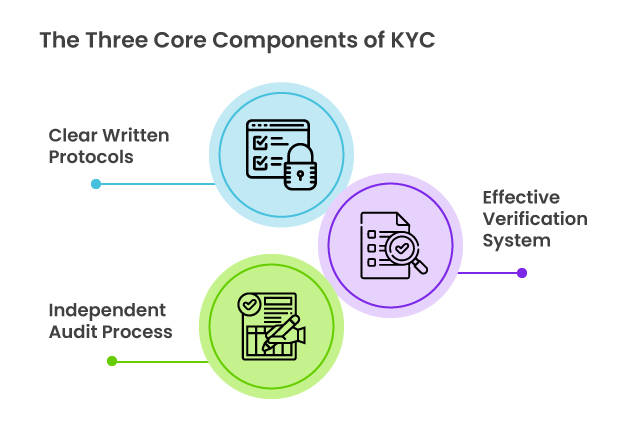

- Clear Written Protocols:

Every financial institution needs to have a detailed and unambiguous Customer Identification Programme (CIP). A well-written CIP outlines procedures, practises, and red flags to watch for. Security software is crucial for storing customer information, preventing identity theft by third parties.

- Effective Verification System:

Robust verification systems are necessary for both in-person and remote interactions. Financial institutions use public records, immigration information, real estate records, and criminal history databases to verify customer information. Software that streamlines this process and on-site inspections are also important tools.

- Independent Audit Process:

Skilled independent auditors evaluate the effectiveness of a financial institution’s CIP and overall AML programme. Regular independent audits help identify areas for improvement and ensure compliance with regulatory standards.

In today’s complex financial landscape, effective KYC processes are indispensable. They protect financial institutions from the risks of non-compliance, including hefty fines and reputational damage. By adhering to stringent KYC requirements, financial institutions can play a crucial role in combating financial crime and ensuring the integrity of the global financial system.

In the increasingly interconnected global financial system, the importance of robust Know Your Customer (KYC) processes cannot be overstated. Effective KYC not only helps institutions combat illegal activities but also safeguards them from significant financial and reputational risks. Non-compliance can result in severe penalties, making it crucial for financial entities to prioritise KYC.

The Growing Importance of KYC

KYC policies are fundamental to the global fight against financial crime, encompassing money laundering, terrorism financing, and other illicit activities. Governments and central banks worldwide are expanding the scope of KYC regulations to cover nearly every part of the global financial ecosystem. This heightened focus on KYC stems from the rising prevalence of financial crime and the increasing number of connections between financial organisations and corporate entities across countries and territories. As more value moves globally each day, the challenge of preventing illegal financial activities grows, prompting regulators to adapt and strengthen KYC checks continuously.

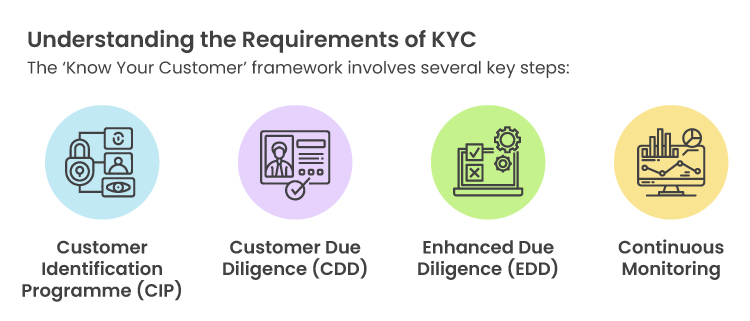

- Customer Identification Programme (CIP):

Financial institutions must obtain essential identifying information from customers, including name, date of birth, address, and identification number. Many organisations also screen customers against government sanctions lists, politically exposed person (PEP) lists, and known terrorism lists. This helps identify individuals requiring enhanced due diligence.

- Customer Due Diligence (CDD):

This process involves sorting and analysing the information gathered during CIP. Financial institutions assess the nature and purpose of customer relationships to ensure they align with known customer profiles. The goal is to confirm customer identity and assess risk, monitoring for unusual activity or changes that may indicate financial crime.

- Enhanced Due Diligence (EDD):

For higher-risk customers, financial institutions conduct more detailed investigations, including source of wealth verification and third-party research. High-risk customers may have political ties, connections to designated individuals, or reside in high-risk countries.

- Continuous Monitoring:

Continuous monitoring is essential as a customer’s situation can change rapidly. Financial institutions must rescreen customers through AML and KYC processes to ensure ongoing eligibility.

The Implications of Non-Compliance

All financial institutions must comply with specific anti-money laundering (AML) regulations, particularly those related to KYC. Originally, these regulations applied primarily to traditional financial institutions such as banks, credit unions, and insurance firms. However, the definition of ‘financial institution’ has broadened over time to include fintech companies, cryptocurrency exchanges, and other non-traditional financial entities.

Failure to comply with KYC regulations can result in severe consequences, including multimillion-dollar fines and criminal prosecution. Non-compliance not only poses financial risks but also damages an institution’s reputation, undermining customer trust and market credibility.

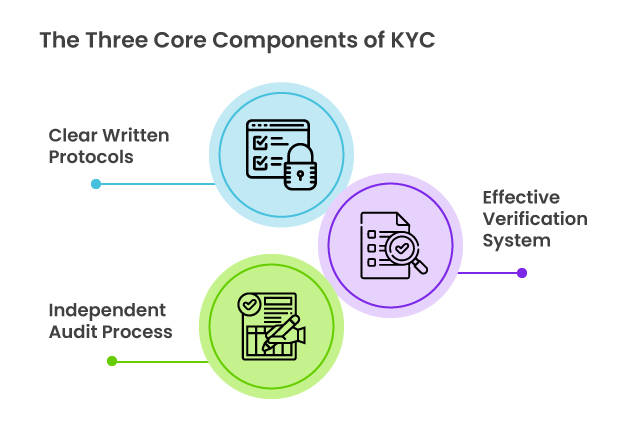

- Clear Written Protocols:

Every financial institution needs to have a detailed and unambiguous Customer Identification Programme (CIP). A well-written CIP outlines procedures, practises, and red flags to watch for. Security software is crucial for storing customer information, preventing identity theft by third parties.

- Effective Verification System:

Robust verification systems are necessary for both in-person and remote interactions. Financial institutions use public records, immigration information, real estate records, and criminal history databases to verify customer information. Software that streamlines this process and on-site inspections are also important tools.

- Independent Audit Process:

Skilled independent auditors evaluate the effectiveness of a financial institution’s CIP and overall AML programme. Regular independent audits help identify areas for improvement and ensure compliance with regulatory standards.

In today’s complex financial landscape, effective KYC processes are indispensable. They protect financial institutions from the risks of non-compliance, including hefty fines and reputational damage. By adhering to stringent KYC requirements, financial institutions can play a crucial role in combating financial crime and ensuring the integrity of the global financial system.