The Essential Role of Digital Core Banking in Modernising Financial Institutions

In today’s fast-paced world, the financial landscape is undergoing a profound evolution driven by the digital revolution. Across the board, financial organisations are prioritising digital transformation as a cornerstone of their strategies. However, while the destination may be similar, the path to digital transformation is unique for each institution.

At the heart of this transformation lies a fundamental shift in how financial institutions perceive technology. No longer relegated to mere support functions, technology is increasingly becoming integrated into the core business strategy. This shift not only acknowledges the inevitability of change but also recognises the immense potential for leveraging digital tools and technical capabilities for profitability and efficiency.

Central to this transformation is the concept of an advanced digital core, capable of seamlessly adapting to multiple tech integrations. By embracing this technological backbone, banks can liberate themselves from the constraints of long-term capital expenditures (CapEx), opting instead for a more economically viable operational expenditure (OpEx) model. This shift not only aligns with modern business practices but also provides the flexibility needed for scalable growth.

Traditional Banking:

Traditional Banking encompasses brick-and-mortar banks holding domestic licenses. While some allow online account opening, physical verification or document submission may be necessary. Despite online transaction capabilities, occasional branch visits are still required.

Digital Core Banking Solution:

Core Banking Solutions (CBS) represents an evolution in the banking industry, providing a modern approach to streamlining processes and improving customer experiences. Built on a microservice-based SOA architecture and supported by an open API approach, the solution provides enterprises with seamless integration capabilities and accelerates digital transformation. CBS enables operational efficiency and consistency across all customer segments by automating end-to-end management of banking processes, including retail, commercial, and transaction banking.

Traditional Banking Vs Digital Core Banking

| Traditional Banking | Digital Core Banking |

|---|---|

| Legacy Systems: Outdated technology and rigid systems hinder innovation and integration. |

Technology Assessment: Evaluate existing systems, identify gaps, and choose suitable modern technologies. |

| Data Migration Complexity: Transfer of large data volumes with accuracy,security, and minimal disruption is challenging. |

Data Management: Prioritises accuracy, quality, and security in migration processes. |

| Regulatory Compliance: Adapting to changing regulations throughout modernisation is difficult. |

Compliance Integration: Ensures new systems comply with industry regulations and standards. |

| Cost and Resource Demands: Traditional Banking equires significant investment, time, and skilled resources. |

Change Management: Engages stakeholders, provides training, and ensures effective communication. |

| Complex Risk Management: Minimising operational risks and ensuring continuity during transition is complex. |

Quality Assurance and Support: Conducts rigorous testing to resolve issues before deployment and provides ongoing maintenance, with continuous improvement. |

WHY DIGITAL CORE BANKING?

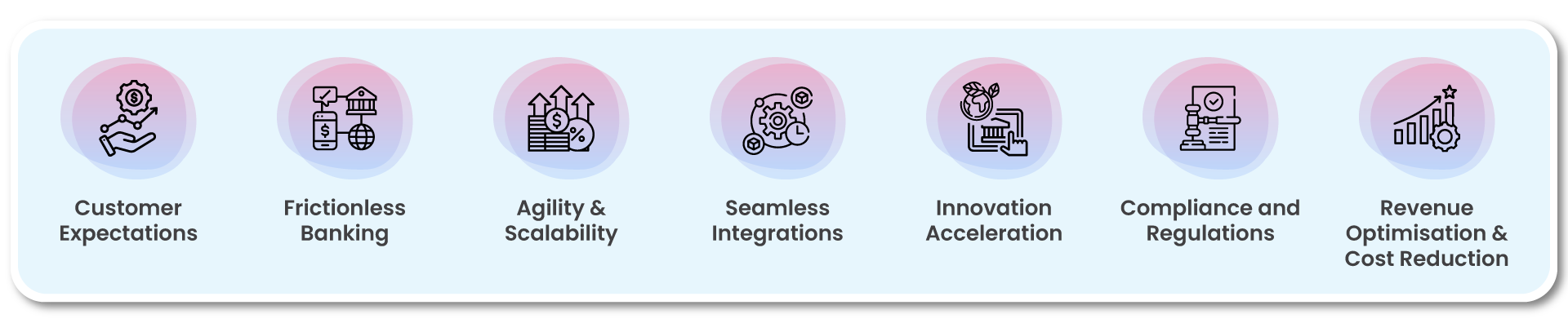

- Customer Expectations: In today’s era of digitalisation, customers no longer settle for basic banking services. They demand a seamless, personalised, and contextually relevant experience across multiple channels, including web, mobile, and in-branch interactions.

- Frictionless Banking: The adoption of a digital core banking system empowers banks to operate with agility, intelligence, and cost-effectiveness. By automating processes, minimising manual interventions, and streamlining operations, banks can offer frictionless experiences to their customers.

- Agility & Scalability: As banks expand their services and grow their customer base, they require a flexible platform that can adapt to varying demands. Leveraging an agile cloud-native digital core enables easy scalability, allowing banks to upgrade services and adjust resources as needed to meet evolving requirements.

- Seamless Integration: The advanced Digital Core Banking platforms ensures seamless integration with existing systems and third-party applications, enabling banks to leverage their current infrastructure while unlocking new possibilities for innovation and growth.

- Innovation Acceleration: Staying competitive in the banking industry necessitates keeping pace with technological advancements. A modern core banking solution facilitates connectivity with the external ecosystem, enabling banks to innovate rapidly and introduce new products and services to the market.

- Compliance and Regulations: The ever-changing regulatory landscape demands swift adaptation from banks. Implementing a cloud-based core banking system ensures compliance with regulations and keeps banks updated with the latest requirements, mitigating risks associated with non-compliance.

- Revenue Optimisation & Cost Reduction: Embracing digital transformation not only enhances operational efficiency but also drives cost reduction for banks. By optimising processes, leveraging automation, and improving customer experiences, banks can achieve significant savings, witness revenue growth, while maintaining service quality.

With this it is safe to say that Digital core banking solutions, encompassing advanced technology platforms such as cloud-native architecture, open APIs, robust security, and data analytics, are revolutionising the finance industry. These solutions integrate seamlessly with multiple capabilities, including trade finance management, digital lending, and microfinance.

With the power of these innovations, financial institutions can offer tailored services, mitigate risks, and improve customer experiences in one go. It serves as the central hub for all banking activities, from customer transactions to back-end processes, offering a unified platform for seamless integration and scalability.

In today’s fast-paced world, the financial landscape is undergoing a profound evolution driven by the digital revolution. Across the board, financial organisations are prioritising digital transformation as a cornerstone of their strategies. However, while the destination may be

similar, the path to digital transformation is unique for each institution.

At the heart of this transformation lies a fundamental shift in how financial institutions perceive technology. No longer relegated to mere support functions, technology is increasingly becoming integrated into the core business strategy. This shift not only acknowledges the inevitability of change but also recognises the immense potential for leveraging digital tools and technical capabilities for profitability and efficiency.

Central to this transformation is the concept of an advanced digital core, capable of seamlessly adapting to multiple tech integrations. By embracing this technological backbone, banks can liberate themselves from the constraints of long-term capital expenditures (CapEx), opting instead for a more economically viable operational expenditure (OpEx) model. This shift not only aligns with modern business practices but also provides the flexibility needed for scalable growth.

Traditional Banking:

Traditional Banking encompasses brick-and-mortar banks holding domestic licenses. While some allow online account opening, physical verification or document submission may be necessary. Despite online transaction capabilities, occasional branch visits are still required.

Digital Core Banking Solution:

Core Banking Solutions (CBS) represents an evolution in the banking industry, providing a modern approach to streamlining processes and improving customer experiences. Built on a microservice-based SOA architecture and supported by an open API approach, the solution provides enterprises with seamless integration capabilities and accelerates digital transformation. CBS enables operational efficiency and consistency across all customer segments by automating end-to-end management of banking processes, including retail, commercial, and transaction banking.

Traditional Banking Vs Digital Core Banking

| Traditional Banking | Digital Core Banking |

|---|---|

| Legacy Systems: Outdated technology and rigid systems hinder innovation and integration. |

Technology Assessment: Evaluate existing systems, identify gaps, and choose suitable modern technologies. |

| Data Migration Complexity: Transfer of large data volumes with accuracy,security, and minimal disruption is challenging. |

Data Management: Prioritises accuracy, quality, and security in migration processes. |

| Regulatory Compliance: Adapting to changing regulations throughout modernisation is difficult. |

Compliance Integration: Ensures new systems comply with industry regulations and standards. |

| Cost and Resource Demands: Traditional Banking equires significant investment, time, and skilled resources. |

Change Management: Engages stakeholders, provides training, and ensures effective communication. |

| Complex Risk Management: Minimising operational risks and ensuring continuity during transition is complex. |

Quality Assurance and Support: Conducts rigorous testing to resolve issues before deployment and provides ongoing maintenance, with continuous improvement. |

WHY DIGITAL CORE BANKING?

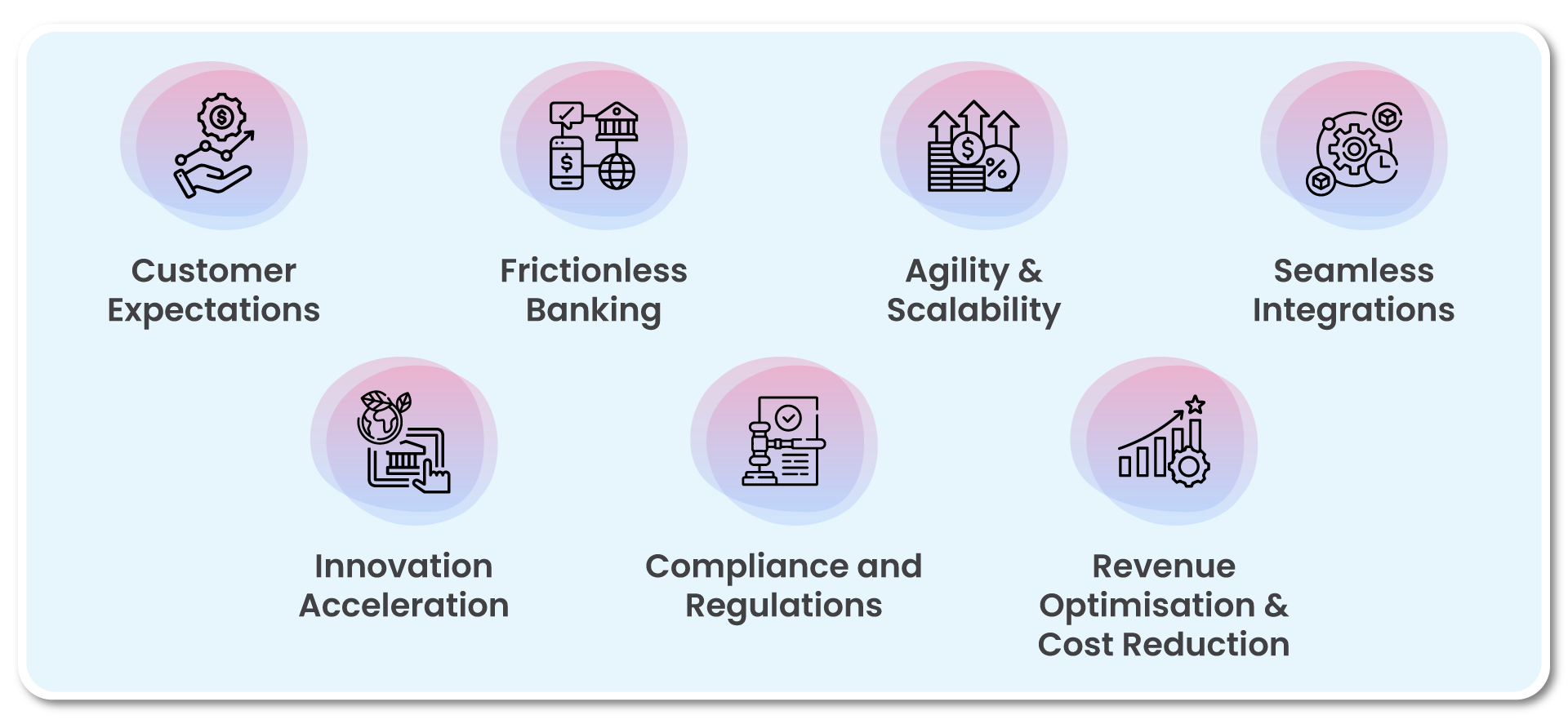

- Customer Expectations: In today’s era of digitalisation, customers no longer settle for basic banking services. They demand a seamless, personalised, and contextually relevant experience across multiple channels, including web, mobile, and in-branch interactions.

- Frictionless Banking: The adoption of a digital core banking system empowers banks to operate with agility, intelligence, and cost-effectiveness. By automating processes, minimising manual interventions, and streamlining operations, banks can offer frictionless experiences to their customers.

- Agility & Scalability: As banks expand their services and grow their customer base, they require a flexible platform that can adapt to varying demands. Leveraging an agile cloud-native digital core enables easy scalability, allowing banks to upgrade services and adjust resources as needed to meet evolving requirements.

- Seamless Integration: The advanced Digital Core Banking platforms ensures seamless integration with existing systems and third-party applications, enabling banks to leverage their current infrastructure while unlocking new possibilities for innovation and growth.

- Innovation Acceleration: Staying competitive in the banking industry necessitates keeping pace with technological advancements. A modern core banking solution facilitates connectivity with the external ecosystem, enabling banks to innovate rapidly and introduce new products and services to the market.

- Compliance and Regulations: The ever-changing regulatory landscape demands swift adaptation from banks. Implementing a cloud-based core banking system ensures compliance with regulations and keeps banks updated with the latest requirements, mitigating risks associated with non-compliance.

- Revenue Optimisation & Cost Reduction: Embracing digital transformation not only enhances operational efficiency but also drives cost reduction for banks. By optimising processes, leveraging automation, and improving customer experiences, banks can achieve significant savings, witness revenue growth, while maintaining service quality.

With this it is safe to say that Digital core banking solutions, encompassing advanced technology platforms such as cloud-native architecture, open APIs, robust security, and data analytics, are revolutionising the finance industry. These solutions integrate seamlessly with multiple capabilities, including trade finance management, digital lending, and microfinance. With the power of these innovations, financial institutions can offer tailored services, mitigate risks, and improve customer experiences in one go. It serves as the central hub for all banking activities, from customer transactions to back-end processes, offering a unified platform for seamless integration and scalability.