The Role of Artificial Intelligence in Fraud Detection and Prevention

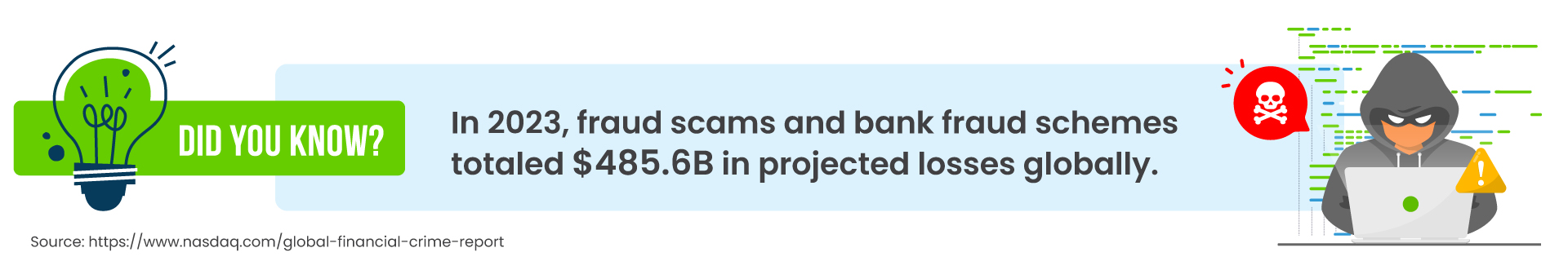

In today’s digital landscape, preventing fraud has become critical for organisations across industries. Traditional methods of fraud detection and prevention are becoming increasingly ineffective as new cyber threats emerge. Now, imagine Artificial Intelligence (AI), a game changer in the fight against fraudulent behaviour.

Fraud detection and prevention solutions with AI capabilities provide a holistic approach to combating fraud. These innovative tools use the massive volumes of data produced in our interconnected world to discover irregularities and patterns indicating fraudulent behaviour. The concept of digital footprints is central to these solutions, with every online action leaving evidence that algorithms can analyse.

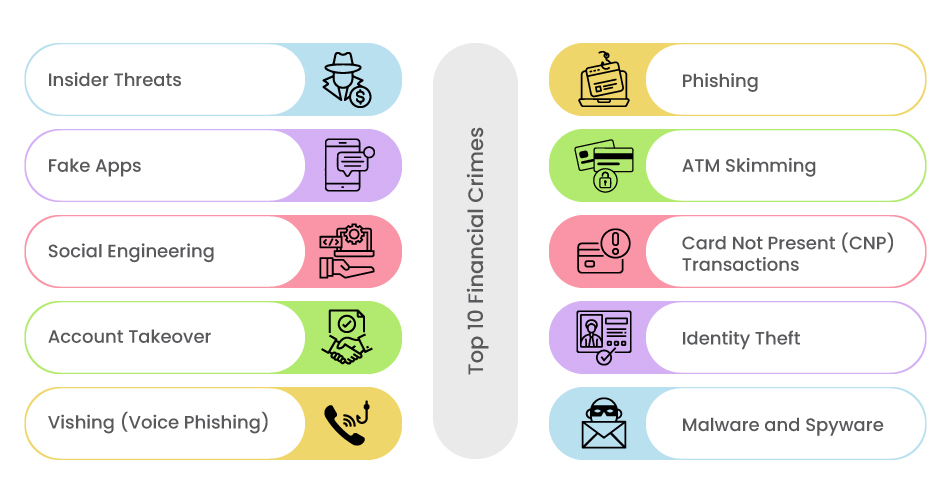

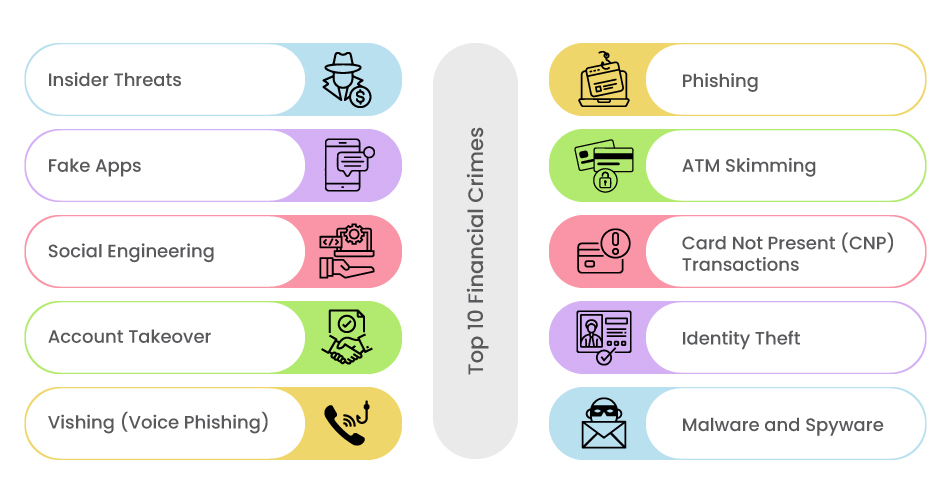

Top 10 Financial Crimes

Traditional Approaches vs. AI-Powered Solutions: Limitations of traditional rule-based systems

With AI at the forefront, fraud monitoring becomes proactive rather than reactive. AI-powered systems can quickly detect suspicious behaviours before they grow into full-fledged fraud activities by monitoring and analysing digital footprints in real time. The speed and accuracy provided by AI allows organisations to stay one step ahead of fraudsters, protecting their assets and reputation. How does AI achieve this success? AI algorithms can filter through massive datasets with unparalleled efficiency thanks to machine learning and predictive analytics. These algorithms can identify possible fraud indications with high accuracy by learning from previous instances and finding subtle patterns. This multitude of actionable insights enables organisations to make informed decisions quickly, reducing the effect of fraudulent activity.

The Versatility of AI in Anti-Fraud Solution

AI-driven AFS is built on the foundation of transaction monitoring, identity verification, and authentication. These elements work together to create an effective defence mechanism against a wide range of fraudulent practices. Whether it’s detecting unauthorised transactions or confirming user identities, AI-powered Anti-Fraud solution offers a comprehensive toolkit for efficiently mitigating fraud.

The versatility of AI-powered AFS emerges through, meeting the different needs of banks and financial institutions across the globe. From real-time fraud detection to predictive analytics for future risks, AI effectively integrates into existing operations, combining human experience with machine intelligence.

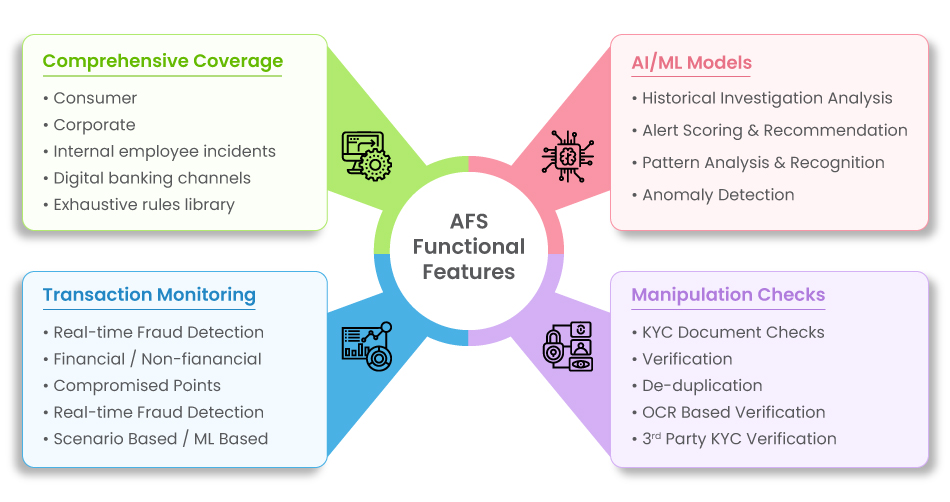

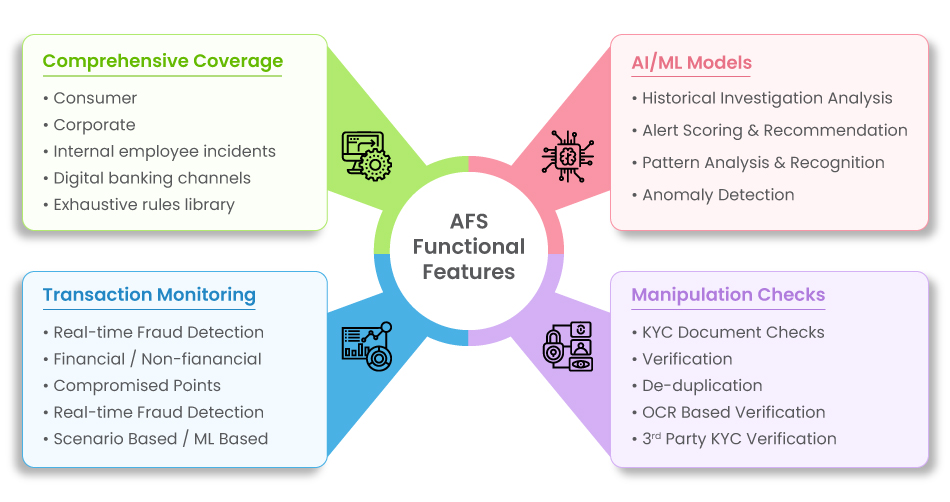

AFS Functional Features

In the complicated world of financial fraud, AI-powered solutions provide a reliable defence strategy for banks and financial institutions. Let’s look at the major components that form the core of these intelligent anti-fraud frameworks:

- Complete Coverage: Financial institutions leverage an extensive rules library to cover diverse fraud scenarios across consumer, corporate, and digital banking channels, ensuring solid protection against evolving threats.

- AI/ML Models: Through historical investigation analysis and anomaly detection, AI-powered models analyse patterns and behaviours, enabling proactive fraud prevention and swift identification of suspicious activities.

- Manipulation Checks: Utilising AI-driven KYC document cheques and Optical Character Recognition (OCR) -based verification, institutions ensure the authenticity of customer information, mitigating the risk of identity theft and fraudulent account openings.

- Transaction Monitoring: Real-time fraud detection and ML-based scenario monitoring empower institutions to swiftly identify and prevent fraudulent transactions, leveraging AI’s adaptive capabilities to stay ahead of emerging threats.

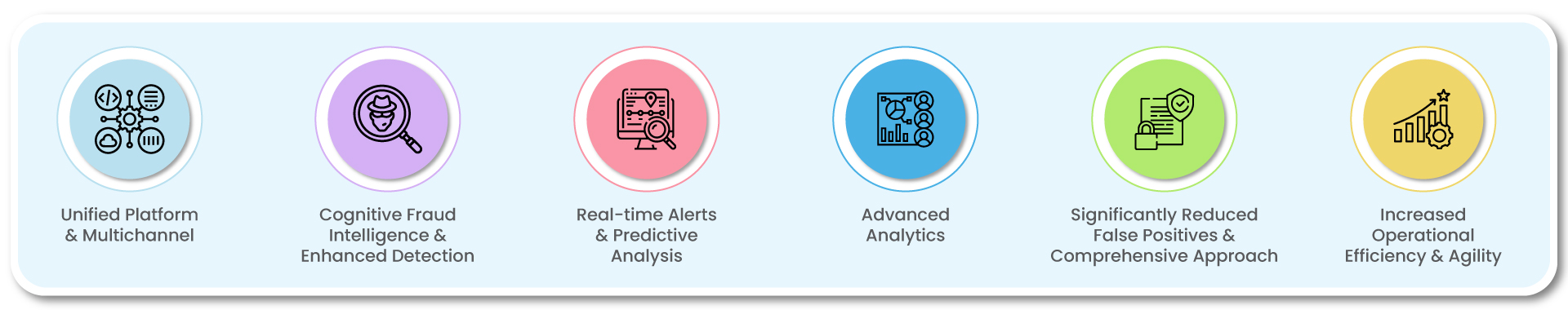

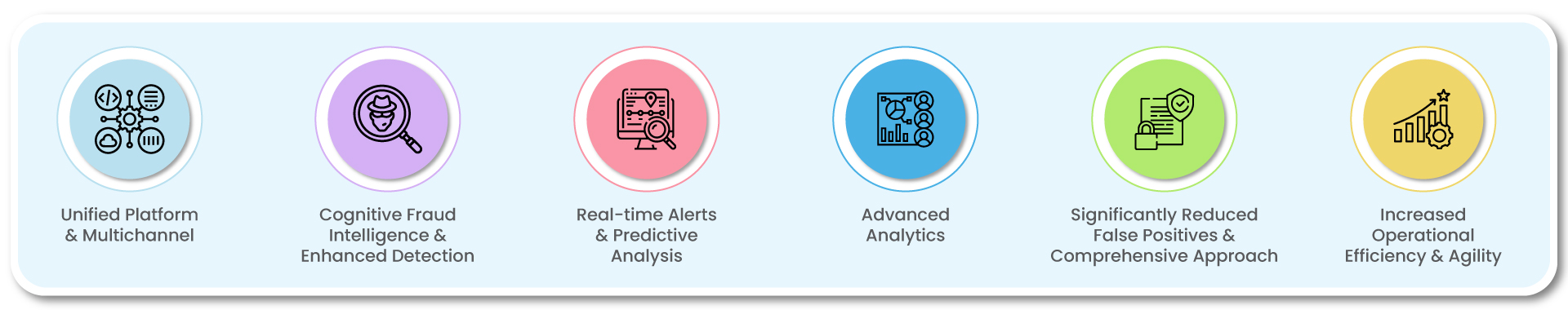

How Can AI-Powered AFS Revolutionise Financial Institutions?

- Unified Platform & Multichannel: Gain a complete understanding of fraud across multiple channels and transaction types in real-time, effectively blocking fraudulent activities across various processes seamlessly.

- Cognitive Fraud Intelligence & Enhanced Detection: Harness AI’s advanced algorithms to detect anomalous patterns and bolster fraud detection capabilities, ensuring accurate alerts and reducing the risk of overlooking potential threats.

- Real-time Alerts & Predictive Analysis: Receive instant alerts for fraudulent activities and utilise predictive analysis and machine learning to automate the handling of complex fraud cases, enabling proactive identification and mitigation of risks.

- Advanced Analytics: Access cutting-edge technology for enhanced fraud detection and prevention through advanced analytics, providing financial institutions with valuable insights to stay ahead of evolving threats.

- Significantly Reduced False Positives & Comprehensive Approach: Minimise false positives, allowing for focused attention on genuine threats, and adopt an inclusive approach to combat fraud across all fronts, from prevention and detection to the elimination of sophisticated criminal activity.

- Increased Operational Efficiency & Agility: Streamline processes and workflows to maximise operational efficiency, seamlessly integrate with existing infrastructure and third-party systems, enhancing functionality, and adaptability for global financial institutions.

With this approach, it is safe to say that AI-powered AFS enables global financial institutions to proactively identify and mitigate fraud threats. By embracing advanced technologies, banks can improve their detection skills and reduce false positives, protecting their assets and reputation. With streamlined processes and a diverse fraud protection strategy, these solutions enable institutions to remain ahead of new threats while maintaining consumer and stakeholder trust.

In today’s digital landscape, preventing fraud has become critical for organisations across industries. Traditional methods of fraud detection and prevention are becoming increasingly ineffective as new cyber threats emerge. Now, imagine Artificial Intelligence (AI), a game changer in the fight against fraudulent behaviour.

Fraud detection and prevention solutions with AI capabilities provide a holistic approach to combating fraud. These innovative tools use the massive volumes of data produced in our interconnected world to discover irregularities and patterns indicating fraudulent behaviour. The concept of digital footprints is central to these solutions, with every online action leaving evidence that algorithms can analyse.

Top 10 Financial Crimes

Traditional Approaches vs. AI-Powered Solutions: Limitations of traditional rule-based systems

With AI at the forefront, fraud monitoring becomes proactive rather than reactive. AI-powered systems can quickly detect suspicious behaviours before they grow into full-fledged fraud activities by monitoring and analysing digital footprints in real time. The speed and accuracy provided by AI allows organisations to stay one step ahead of fraudsters, protecting their assets and reputation. How does AI achieve this success? AI algorithms can filter through massive datasets with unparalleled efficiency thanks to machine learning and predictive analytics. These algorithms can identify possible fraud indications with high accuracy by learning from previous instances and finding subtle patterns. This multitude of actionable insights enables organisations to make informed decisions quickly, reducing the effect of fraudulent activity.

The Versatility of AI in Anti-Fraud Solution

AI-driven AFS is built on the foundation of transaction monitoring, identity verification, and authentication. These elements work together to create an effective defence mechanism against a wide range of fraudulent practices. Whether it’s detecting unauthorised transactions or confirming user identities, AI-powered Anti-Fraud solution offers a comprehensive toolkit for efficiently mitigating fraud.

The versatility of AI-powered AFS emerges through, meeting the different needs of banks and financial institutions across the globe. From real-time fraud detection to predictive analytics for future risks, AI effectively integrates into existing operations, combining human experience with machine intelligence.

AFS Functional Features

In the complicated world of financial fraud, AI-powered solutions provide a reliable defence strategy for banks and financial institutions. Let’s look at the major components that form the core of these intelligent anti-fraud frameworks:

- Complete Coverage: Financial institutions leverage an extensive rules library to cover diverse fraud scenarios across consumer, corporate, and digital banking channels, ensuring solid protection against evolving threats.

- AI/ML Models: Through historical investigation analysis and anomaly detection, AI-powered models analyse patterns and behaviours, enabling proactive fraud prevention and swift identification of suspicious activities.

- Manipulation Checks: Utilising AI-driven KYC document cheques and Optical Character Recognition (OCR) -based verification, institutions ensure the authenticity of customer information, mitigating the risk of identity theft and fraudulent account openings.

- Transaction Monitoring: Real-time fraud detection and ML-based scenario monitoring empower institutions to swiftly identify and prevent fraudulent transactions, leveraging AI’s adaptive capabilities to stay ahead of emerging threats.

How Can AI-Powered AFS Revolutionise Financial Institutions?

- Unified Platform & Multichannel: Gain a complete understanding of fraud across multiple channels and transaction types in real-time, effectively blocking fraudulent activities across various processes seamlessly.

- Cognitive Fraud Intelligence & Enhanced Detection: Harness AI’s advanced algorithms to detect anomalous patterns and bolster fraud detection capabilities, ensuring accurate alerts and reducing the risk of overlooking potential threats.

- Real-time Alerts & Predictive Analysis: Receive instant alerts for fraudulent activities and utilise predictive analysis and machine learning to automate the handling of complex fraud cases, enabling proactive identification and mitigation of risks.

- Advanced Analytics: Access cutting-edge technology for enhanced fraud detection and prevention through advanced analytics, providing financial institutions with valuable insights to stay ahead of evolving threats.

- Significantly Reduced False Positives & Comprehensive Approach: Minimise false positives, allowing for focused attention on genuine threats, and adopt an inclusive approach to combat fraud across all fronts, from prevention and detection to the elimination of sophisticated criminal activity.

- Increased Operational Efficiency & Agility: Streamline processes and workflows to maximise operational efficiency, seamlessly integrate with existing infrastructure and third-party systems, enhancing functionality, and adaptability for global financial institutions.

With this approach, it is safe to say that AI-powered AFS enables global financial institutions to proactively identify and mitigate fraud threats. By embracing advanced technologies, banks can improve their detection skills and reduce false positives, protecting their assets and reputation. With streamlined processes and a diverse fraud protection strategy, these solutions enable institutions to remain ahead of new threats while maintaining consumer and stakeholder trust.