Unlocking the Power of AI in Credit Risk Assessment

In today’s interconnected global economy, managing credit risk is a top priority for organisations of all sizes. From large organisations to micro-enterprises, handling the complexities of credit risk has become an essential part of financial strategy. Enterprise credit teams face the difficulty of managing multiple accounts across linguistic barriers and changing currencies. The stakes are high, as effective credit risk management acts as an obstacle to the rising threat of financial loss, protecting firms from the adverse effects of defaulting customers or counterparties. In this rapidly evolving world, the inability to responsibly manage credit risk can set off a chain reaction of consequences, ranging from financial insecurity to the approaching threat of insolvency or bankruptcy. Therefore, for firms to strengthen their credit risk management frameworks is not only advisable but also a cornerstone of adaptability in a fluctuating economy.

The Role of AI in Credit Risk Analysis and Management

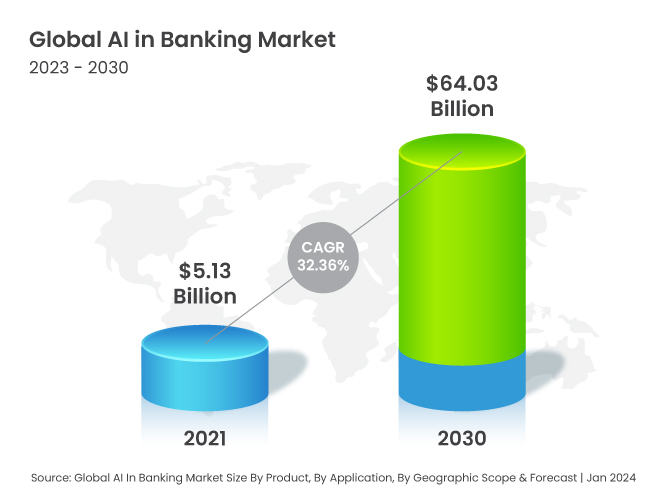

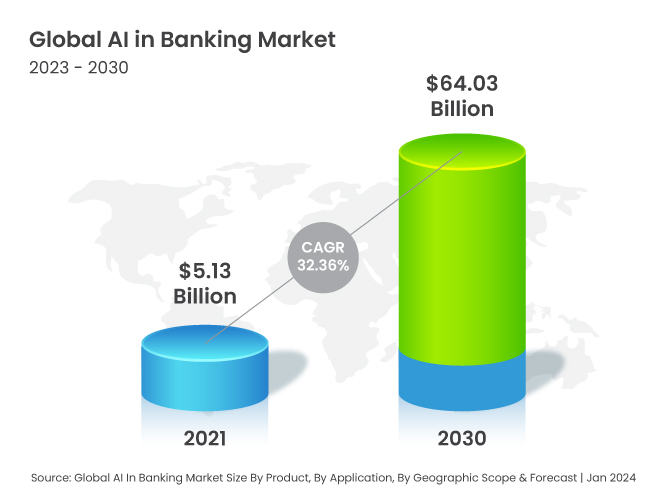

Artificial Intelligence (AI) has emerged as the third major technological revolution in economic history, following the advent of industrial production in the 19th century and the rise of computer science in the 20th. At its core, AI involves the replication of human intelligence processes by machines, including a wide range of problem-solving capabilities. Within this domain, machine learning (ML) stands out as a fundamental sub-field, allowing computers to autonomously learn rules from data. This dynamic evolution of technology, encompassing AI, ML, and predictive analytics, is reshaping the landscape of financial services. Banks are leveraging these upgrades to analyse customer data more effectively, facilitating efficient loan provisioning.

In the financial sector, credit risk analysis and management hold particular significance for banks and financial institutions that serve retail and SMEs. AI-powered solutions allow these organisations to go further into client data, improving their ability to assess creditworthiness and manage associated risks. By leveraging machine learning algorithms and predictive analytics, banks can make more informed decisions, optimizing loan processes and improving overall portfolio performance. This integration of AI technologies into credit risk analysis signifies a new era in the financial services industry, enabling greater efficiency, accuracy, and adaptability in loan management.

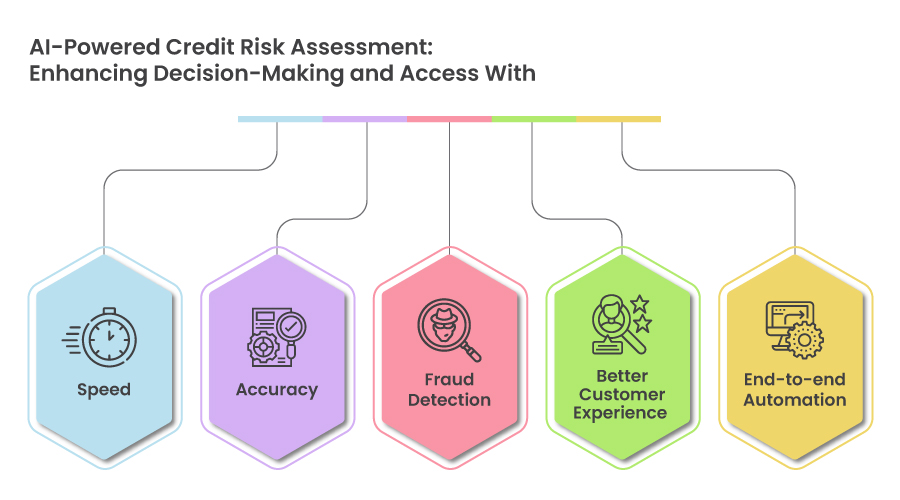

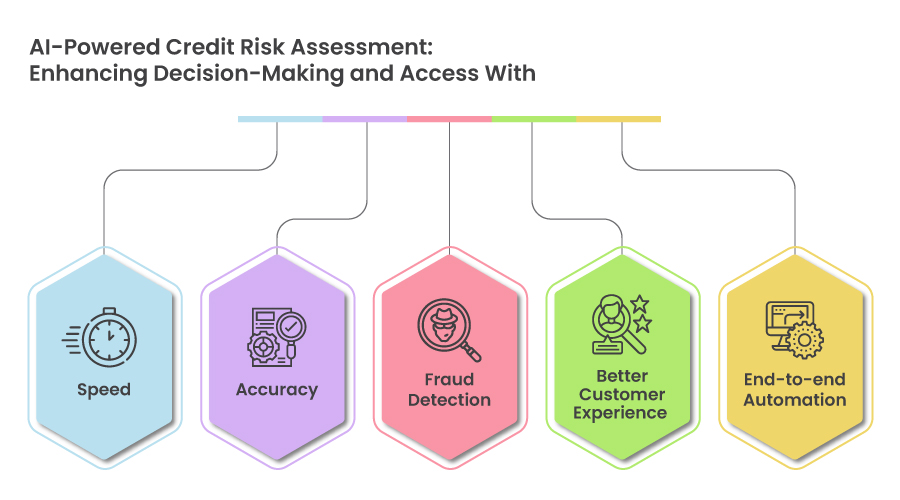

Title: AI-Powered Credit Risk Assessment: Enhancing Decision-Making and Access With

Artificial intelligence has a significant impact on credit scoring, offering a transformative approach compared to traditional models. Conventional scoring systems often struggle to capture the complexities and fluctuations of individual financial habits. AI, on the other hand has the capacity to analyse extensive datasets, recognise patterns, and generate predictions with remarkable precision. This allows for a more personalised and equitable examination of creditworthiness. Furthermore, by introducing alternative data into the scoring process, AI-driven credit scoring has the potential to increase credit availability for minorities, such as those with limited credit histories or newbies to the credit market

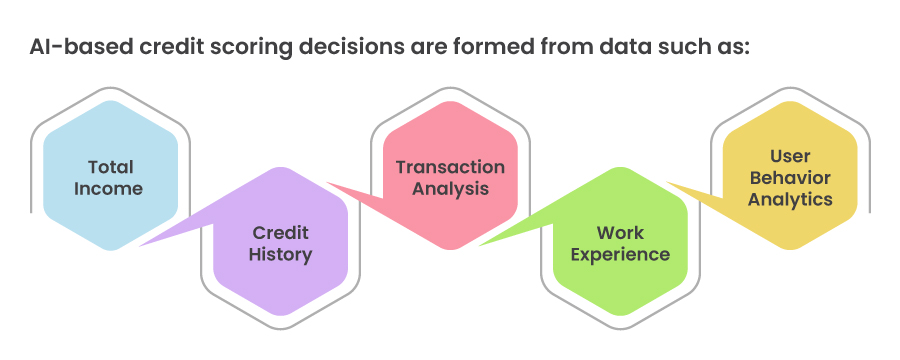

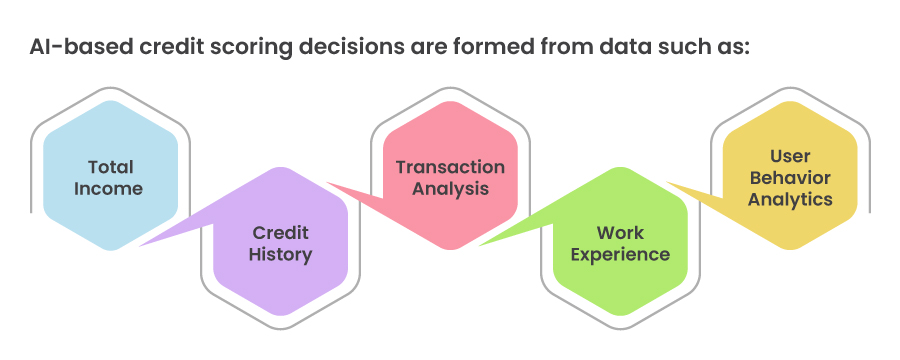

AI-based credit scoring decisions are formed from data such as:

Shape Tomorrow’s Financial Landscape with AI-Powered Lending Solutions

As we look ahead, the roadmap of credit risk management indicates a scenario in which AI plays a central role in decision-making processes, operating independently without human intervention. Machine learning algorithms are already speeding up decision-making processes and analysing large datasets in real time with greater precision. One possible advantage of autonomous credit risk management is that it reduces discrimination and human error while promoting independence and uniformity in decision-making. Furthermore, these systems can adapt and evolve to new data inputs, improving their accuracy and usefulness over time.

As we build tomorrow’s financial landscape, the use of AI in lending solutions emerges as a driving force for success. By adopting these cutting-edge technologies, we not only optimise lending operations, but also pave the path for a more inclusive and robust financial environment.

In today’s interconnected global economy, managing credit risk is a top priority for organisations of all sizes. From large organisations to micro-enterprises, handling the complexities of credit risk has become an essential part of financial strategy. Enterprise credit teams face the difficulty of managing multiple accounts across linguistic barriers and changing currencies. The stakes are high, as effective credit risk management acts as an obstacle to the rising threat of financial loss, protecting firms from the adverse effects of defaulting customers or counterparties. In this rapidly evolving world, the inability to responsibly manage credit risk can set off a chain reaction of consequences, ranging from financial insecurity to the approaching threat of insolvency or bankruptcy. Therefore, for firms to strengthen their credit risk management frameworks is not only advisable but also a cornerstone of adaptability in a fluctuating economy.

The Role of AI in Credit Risk Analysis and Management

Artificial Intelligence (AI) has emerged as the third major technological revolution in economic history, following the advent of industrial production in the 19th century and the rise of computer science in the 20th. At its core, AI involves the replication of human intelligence processes by machines, including a wide range of problem-solving capabilities. Within this domain, machine learning (ML) stands out as a fundamental sub-field, allowing computers to autonomously learn rules from data. This dynamic evolution of technology, encompassing AI, ML, and predictive analytics, is reshaping the landscape of financial services. Banks are leveraging these upgrades to analyse customer data more effectively, facilitating efficient loan provisioning.

In the financial sector, credit risk analysis and management hold particular significance for banks and financial institutions that serve retail and SMEs. AI-powered solutions allow these organisations to go further into client data, improving their ability to assess creditworthiness and manage associated risks. By leveraging machine learning algorithms and predictive analytics, banks can make more informed decisions, optimizing loan processes and improving overall portfolio performance. This integration of AI technologies into credit risk analysis signifies a new era in the financial services industry, enabling greater efficiency, accuracy, and adaptability in loan management.

AI-Powered Credit Risk Assessment: Enhancing Decision-Making and Access With

Artificial intelligence has a significant impact on credit scoring, offering a transformative approach compared to traditional models. Conventional scoring systems often struggle to capture the complexities and fluctuations of individual financial habits. AI, on the other hand has the capacity to analyse extensive datasets, recognise patterns, and generate predictions with remarkable precision. This allows for a more personalised and equitable examination of creditworthiness. Furthermore, by introducing alternative data into the scoring process, AI-driven credit scoring has the potential to increase credit availability for minorities, such as those with limited credit histories or newbies to the credit market

AI-based credit scoring decisions are formed from data such as:

Shape Tomorrow’s Financial Landscape with AI-Powered Lending Solutions

As we look ahead, the roadmap of credit risk management indicates a scenario in which AI plays a central role in decision-making processes, operating independently without human intervention. Machine learning algorithms are already speeding up decision-making processes and analysing large datasets in real time with greater precision. One possible advantage of autonomous credit risk management is that it reduces discrimination and human error while promoting independence and uniformity in decision-making. Furthermore, these systems can adapt and evolve to new data inputs, improving their accuracy and usefulness over time.

As we build tomorrow’s financial landscape, the use of AI in lending solutions emerges as a driving force for success. By adopting these cutting-edge technologies, we not only optimise lending operations, but also pave the path for a more inclusive and robust financial environment.