UPI Circle: Empowering Delegated Payments for Seamless Financial Management

In an era of increasing financial interdependence, flexible and shared payment solutions have become essential. UPI Circle, one more revolutionary product from the National Payment Corporation of India (NPCI) steps in as a great feature, transforming the way we handle online payments. It enables users to share their primary UPI account with others, offering a convenient, secure, and controlled way to delegate payments. Whether it’s providing a family member with spending access or empowering employees to manage on-the-go expenses, UPI Circle introduces an entirely new level of financial flexibility. As digital payments become essential in modern life, many users seek ways to share access without compromising control. UPI Circle provides that solution.

This powerful solution eliminates the need for each user to have a bank account linked to UPI while maintaining a strong layer of security through full or partial delegation. Be it college students, homemakers, senior citizens, or small business owners, it encourages everyone to participate in digital payments without the complexity of multiple accounts or the risk of handling cash.

UPI Circle: Bridging Financial Gaps with Delegated Payments

UPI Circle isn’t just a tool for making payments; it’s a solution for making shared financial responsibilities easier, safer, and more efficient. Whether managing personal finances across family members or streamlining business operations, UPI Circle ensures everyone involved can transact with confidence and control.

How UPI Circle Works: Simplifying Shared Digital Payments

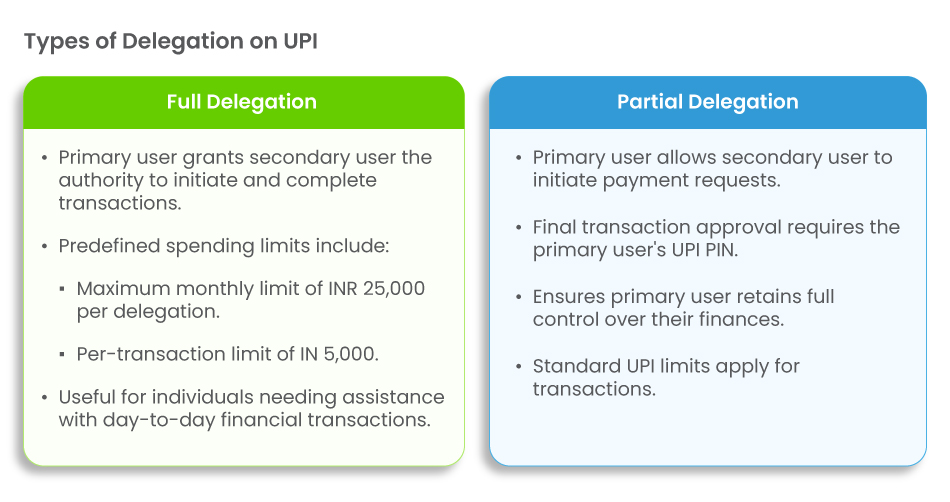

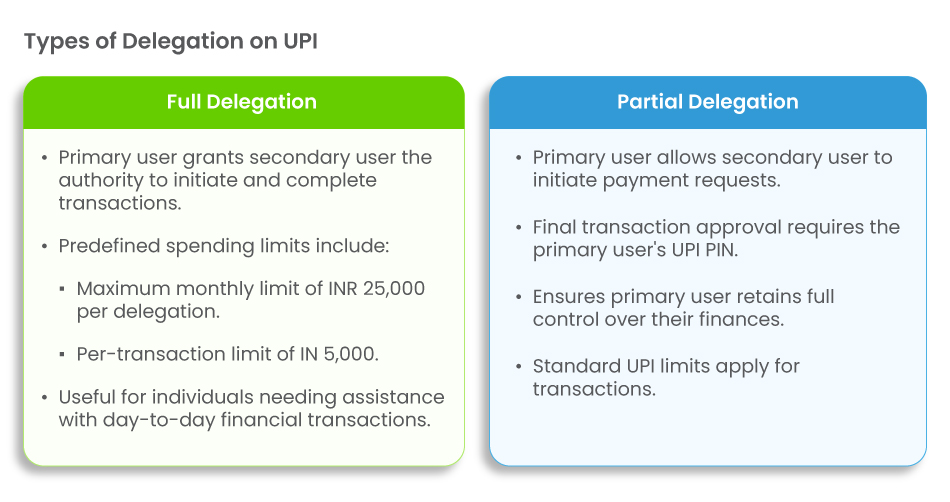

UPI Circle is a feature that enables the primary UPI account holder to delegate payment authority to secondary users in a controlled and secure manner. With two flexible delegation options—full delegation and partial delegation—it can be tailored to suit individual needs. Additionally, users have the flexibility to switch between these modes as needed.

- Full Delegation:

The primary user sets a transaction limit for the secondary user, who can make payments without needing individual approval for each transaction, as long as the total remains within the agreed threshold.

- Partial Delegation:

In this case, the secondary user requires authorisation from the primary user for every transaction, providing additional control while still enabling shared access to the UPI account.

This feature is designed to support individuals without a UPI-linked bank account, making digital payments accessible to a broader audience. It offers a secure and flexible way for family members, business owners, and other stakeholders to delegate payment authority without compromising the safety or control of the primary user.

UPI Circle is particularly useful for those who manage finances for others or are responsible for a group’s expenses. This system provides more than just convenience—it offers a reliable, secure, and monitored environment for delegated payments, enabling people to handle daily financial tasks with ease.

Real-Life Applications of UPI Circle: Uncovering Financial Flexibility

- Smart Allowance: Empowering College Students

Rahul, a junior college student, often needs money for stationery, travel, and food. His father, Ravi, uses UPI Circle to allow Rahul to make small, essential purchases without carrying cash. Ravi sets a spending limit, and Rahul can pay for his daily needs through UPI, while Ravi keeps track of every transaction to ensure that the money is used wisely. This system not only keeps Rahul cash-free but also provides Ravi the assurance of responsible spending.

- Household Manager: Simplifying Homemaker Payments

Meena handles all the household shopping, but it’s her husband, Raj, who has the UPI-linked bank account. With UPI Circle, Raj provides Meena access to make everyday payments, such as buying groceries and household essentials, within set limits. Meena can now take care of all the household expenses without needing cash or waiting for Raj’s approval on every purchase. It’s a seamless way for the couple to manage finances together.

- Stress-Free Shopping: Assisting Senior Citizens

Mr. Kumar, a retired individual, enjoys going out for his daily errands but feels uncertain about making digital payments on his own. His daughter, Priya, uses UPI Circle to give him the ability to pay for items while ensuring she can authorise each transaction remotely. This arrangement lets Mr. Kumar handle his shopping independently, knowing Priya is there to manage the payments securely.

- Business on the Go: Managing Staff Expenses

Sunita, the owner of a small car rental company, frequently has to provide petty cash for her drivers to make fuel payments or cover other expenses while they’re on the job. Instead of handling cash, she enables UPI Circle, allowing her drivers to pay directly from her account within pre-set limits. This not only reduces the risk of cash handling but also helps Sunita monitor and control her business expenses efficiently.

Why UPI Circle?

UPI Circle is more than a convenience; it’s a step towards realising a broader vision. NPCI and the Government of India have been at the forefront of initiatives that foster financial inclusion, financial literacy, and the Digital India mission. By simplifying access to digital payments, UPI Circle bridges gaps that have traditionally limited financial participation for certain segments of the population, such as students, homemakers, senior citizens, and small business owners.

This innovation not only empowers individuals to take charge of their finances but also aligns with the government’s commitment to a cashless economy, reducing reliance on physical currency and promoting transparency. UPI Circle supports economic growth by enabling more people to actively engage in digital transactions, thus contributing to the larger goal of a more digitally inclusive society.

As more users adopt digital payment systems like UPI Circle, the ripple effect can strengthen the economy by driving efficiency, reducing costs associated with cash handling, and fostering a culture of trust and confidence in digital transactions. This fosters an environment where financial literacy can thrive, as more people are encouraged to understand and utilise digital payment solutions in their everyday lives.

Learn more about how KiyaAI, as the trusted NPCI technology partner and solution enabler can enhance your organisation’s digital payment infrastructure with our secure, seamless, and scalable digital solutions that align with modern needs and regulatory standards.

In an era of increasing financial interdependence, flexible and shared payment solutions have become essential. UPI Circle, one more revolutionary product from the National Payment Corporation of India (NPCI) steps in as a great feature, transforming the way we handle online payments. It enables users to share their primary UPI account with others, offering a convenient, secure, and controlled way to delegate payments. Whether it’s providing a family member with spending access or empowering employees to manage on-the-go expenses, UPI Circle introduces an entirely new level of financial flexibility. As digital payments become essential in modern life, many users seek ways to share access without compromising control. UPI Circle provides that solution.

This powerful solution eliminates the need for each user to have a bank account linked to UPI while maintaining a strong layer of security through full or partial delegation. Be it college students, homemakers, senior citizens, or small business owners, it encourages everyone to participate in digital payments without the complexity of multiple accounts or the risk of handling cash.

UPI Circle: Bridging Financial Gaps with Delegated Payments

UPI Circle isn’t just a tool for making payments; it’s a solution for making shared financial responsibilities easier, safer, and more efficient. Whether managing personal finances across family members or streamlining business operations, UPI Circle ensures everyone involved can transact with confidence and control.

How UPI Circle Works: Simplifying Shared Digital Payments

UPI Circle is a feature that enables the primary UPI account holder to delegate payment authority to secondary users in a controlled and secure manner. With two flexible delegation options—full delegation and partial delegation—it can be tailored to suit individual needs. Additionally, users have the flexibility to switch between these modes as needed.

- Full Delegation:

The primary user sets a transaction limit for the secondary user, who can make payments without needing individual approval for each transaction, as long as the total remains within the agreed threshold.

- Partial Delegation:

In this case, the secondary user requires authorisation from the primary user for every transaction, providing additional control while still enabling shared access to the UPI account.

This feature is designed to support individuals without a UPI-linked bank account, making digital payments accessible to a broader audience. It offers a secure and flexible way for family members, business owners, and other stakeholders to delegate payment authority without compromising the safety or control of the primary user.

UPI Circle is particularly useful for those who manage finances for others or are responsible for a group’s expenses. This system provides more than just convenience—it offers a reliable, secure, and monitored environment for delegated payments, enabling people to handle daily financial tasks with ease.

Real-Life Applications of UPI Circle: Uncovering Financial Flexibility

- Smart Allowance: Empowering College Students

Rahul, a junior college student, often needs money for stationery, travel, and food. His father, Ravi, uses UPI Circle to allow Rahul to make small, essential purchases without carrying cash. Ravi sets a spending limit, and Rahul can pay for his daily needs through UPI, while Ravi keeps track of every transaction to ensure that the money is used wisely. This system not only keeps Rahul cash-free but also provides Ravi the assurance of responsible spending.

- Household Manager: Simplifying Homemaker Payments

Meena handles all the household shopping, but it’s her husband, Raj, who has the UPI-linked bank account. With UPI Circle, Raj provides Meena access to make everyday payments, such as buying groceries and household essentials, within set limits. Meena can now take care of all the household expenses without needing cash or waiting for Raj’s approval on every purchase. It’s a seamless way for the couple to manage finances together.

- Stress-Free Shopping: Assisting Senior Citizens

Mr. Kumar, a retired individual, enjoys going out for his daily errands but feels uncertain about making digital payments on his own. His daughter, Priya, uses UPI Circle to give him the ability to pay for items while ensuring she can authorise each transaction remotely. This arrangement lets Mr. Kumar handle his shopping independently, knowing Priya is there to manage the payments securely.

- Business on the Go: Managing Staff Expenses

Sunita, the owner of a small car rental company, frequently has to provide petty cash for her drivers to make fuel payments or cover other expenses while they’re on the job. Instead of handling cash, she enables UPI Circle, allowing her drivers to pay directly from her account within pre-set limits. This not only reduces the risk of cash handling but also helps Sunita monitor and control her business expenses efficiently.

Why UPI Circle?

UPI Circle is more than a convenience; it’s a step towards realising a broader vision. NPCI and the Government of India have been at the forefront of initiatives that foster financial inclusion, financial literacy, and the Digital India mission. By simplifying access to digital payments, UPI Circle bridges gaps that have traditionally limited financial participation for certain segments of the population, such as students, homemakers, senior citizens, and small business owners.

This innovation not only empowers individuals to take charge of their finances but also aligns with the government’s commitment to a cashless economy, reducing reliance on physical currency and promoting transparency. UPI Circle supports economic growth by enabling more people to actively engage in digital transactions, thus contributing to the larger goal of a more digitally inclusive society.

As more users adopt digital payment systems like UPI Circle, the ripple effect can strengthen the economy by driving efficiency, reducing costs associated with cash handling, and fostering a culture of trust and confidence in digital transactions. This fosters an environment where financial literacy can thrive, as more people are encouraged to understand and utilise digital payment solutions in their everyday lives.

Learn more about how KiyaAI, as the trusted NPCI technology partner and solution enabler can enhance your organisation’s digital payment infrastructure with our secure, seamless, and scalable digital solutions that align with modern needs and regulatory standards.